Introduction

Picture this: every month your paycheck arrives and bills start flowing out. By the time you get to the end of the month, there is little or nothing left for savings. Sound familiar? Many of us intend to save but treat saving as something we do with whatever remains after spending. The “pay yourself first” method flips this idea on its head. Instead of hoping there will be money left over, you prioritize your own future. Before a single dollar goes toward groceries, streaming services or dining out, you set aside a fixed amount for your savings goals.

Financial educators at the University of Pennsylvania observe that there is no one‑size‑fits‑all budget and they highlight several approaches, including the pay‑yourself‑first method. In this reverse budgeting strategy you decide how much to save for goals and “pay” your savings account firstfidelity.com. Fidelity notes that intentionally planning savings—whether for an emergency fund or retirement—improves insight into your finances and helps curb impulsive spendingfidelity.com. This article will explore the pay‑yourself‑first method in detail, showing you how it works, why it can transform your finances and how it compares with other budgeting systems.

What Does “Pay Yourself First” Mean?

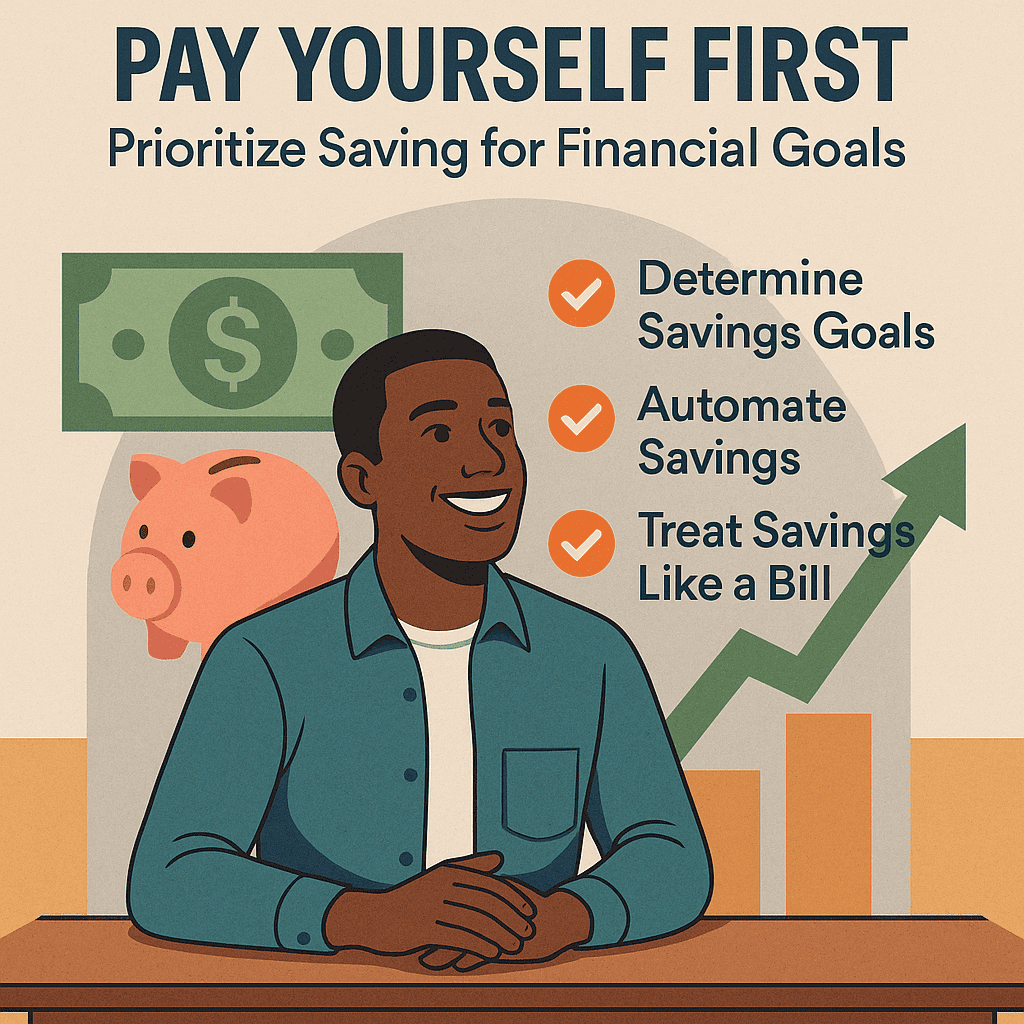

The pay‑yourself‑first (PYF) method is a savings‑first approach. Instead of listing expenses and hoping to save what’s left, you treat saving as a non‑negotiable expense. It has three core principles:

- Set a savings target before anything else. Determine what percentage of your net income you want to save—this might be 10 %, 20 % or more depending on your goals. Many people start with the “80/20” version: 20 % to savings and 80 % to everything else. Financial education sources suggest that deciding on this amount upfront ensures you make consistent progress.

- Automate your savings. Once you decide on a percentage or dollar amount, set up an automatic transfer from your checking account to your savings or investment account on payday. Automating removes the temptation to spend the money elsewhere.

- Live on what remains. After paying yourself, you cover essential expenses (housing, utilities, food) and discretionary spending with the leftover funds. If money is tight, you may need to trim discretionary items, but the savings contribution stays intact.

Why It Works

- Prioritizes your goals. By treating saving as mandatory, you are literally paying your future self. You build funds for short‑term goals (holiday travel, a new laptop) and long‑term goals (down payment on a home, retirement).

- Reduces decision fatigue. Because the transfer happens automatically, you don’t have to decide each month whether to save. It becomes a habit.

- Creates a buffer against emergencies. Building an emergency fund protects you from financial shocks. The Consumer Financial Protection Bureau emphasizes that having a dedicated emergency fund helps you recover from unexpected expenses and get back on trackconsumerfinance.gov.

- Encourages mindful spending. When you see how much remains after paying yourself first, you become more mindful of how you use those dollars. You may naturally adjust your lifestyle to fit within your means.

Getting Started With Pay Yourself First

1. Define Your Savings Goals

Begin by listing what you want to save for. Goals often fall into three categories:

- Emergency fund. A safety net covering 3‑6 months of essential expenses. The CFPB notes that people who have dedicated emergency savings recover faster from unexpected expensesconsumerfinance.gov.

- Short‑term goals. Money for events within the next 1‑5 years: a wedding, a vacation, a home down payment, or paying off high‑interest debt.

- Long‑term goals. Retirement savings, children’s education funds or financial independence.

Knowing your targets will help determine how much to save. For example, if you want to build a $5,000 emergency fund over two years, you need to put away about $208 monthly. If you also plan to contribute to retirement, factor that into your total saving percentage.

2. Calculate Your Net Income

Calculate your take‑home pay (after taxes and deductions). This figure is important because budgeting and saving percentages are typically based on net income. For example, if your monthly take‑home pay is $3,000 and you decide on an 80/20 split, you will automatically save $600 and live on $2,400.

3. Decide on Your Savings Rate

While the 80/20 split is a popular version of PYF, the rate you choose should reflect your goals, income and expenses.

- Start small if necessary. If your budget is tight, start with 5 % or 10 %. As your income grows or debts decrease, increase your rate.

- Use windfalls wisely. Tax refunds, bonuses or gifts can be funneled into savings.

- Aim for 20 % or more. Many experts recommend saving at least 20 % if possible. A higher rate accelerates progress on goals and builds resilience.

4. Automate Transfers

Automating your savings eliminates the need to remember each payday. Most employers let you split direct deposits between checking and savings accounts, or you can set up recurring transfers with your bank. Consider sending the money to different accounts dedicated to each goal—one for emergency fund, one for retirement, etc.

5. Monitor and Adjust

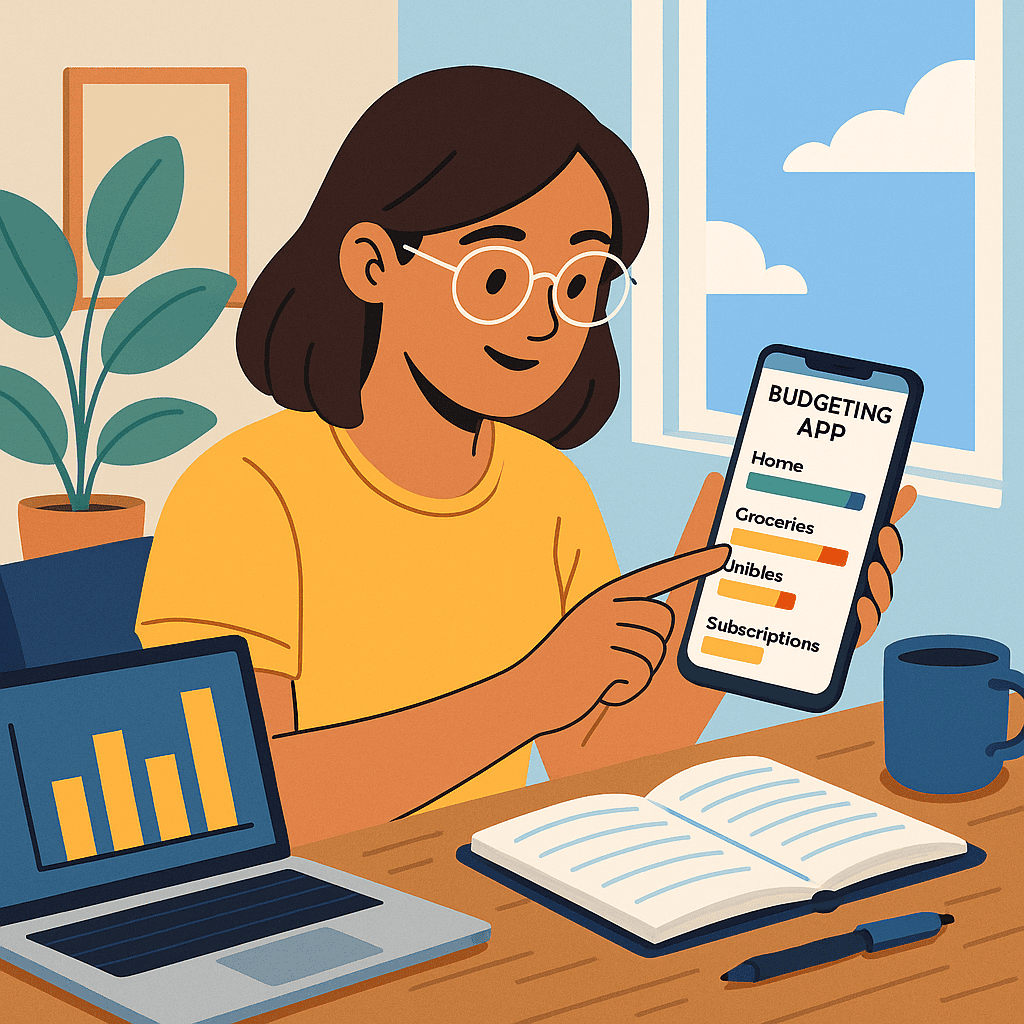

After implementing PYF, track your progress. Use budgeting apps or spreadsheets to monitor spending and ensure you stay within your remaining budget. If you notice that you consistently overspend, adjust discretionary categories (e.g., dining out or subscriptions) instead of reducing your savings contribution. The University of Pennsylvania’s budgeting strategies emphasise customising the budget to fit your lifestyle, and the PYF method is flexible—you can increase or decrease your savings rate as circumstances change.

Advantages of Pay Yourself First

| Advantage | Explanation |

|---|---|

| Guaranteed savings | By making savings the first “expense,” you consistently build wealth rather than hoping money is left over. |

| Goal‑oriented | Knowing you’re working toward specific goals (emergency fund, retirement) provides motivation and a sense of progress. |

| Reduces impulse spending | With less discretionary income, you’re less tempted by unnecessary purchases. |

| Flexible and customizable | You can choose any savings percentage and adjust it over time. The method works for various incomes and goalsfidelity.com. |

| Encourages financial discipline | Treating saving like a bill trains you to live below your means and gives you control over your financial future. |

Potential Drawbacks and Solutions

While powerful, the pay‑yourself‑first approach has challenges:

- Tighter cash flow: Because savings come off the top, you may have less to spend. Solution: Start with a modest percentage and build up.

- Requires planning and tracking: You need to know your income and expenses well. The Fidelity article points out that budgeting methods like PYF require more planning and can be challenging for those with variable incomefidelity.com. Solution: Use apps or spreadsheets to track spending and average your income over several months.

- Can be difficult with irregular pay: Those with variable income (freelancers, gig workers) may not know how much they can save each month. Fidelity recommends basing your savings percentage on the lowest monthly income in your recent historyfidelity.com. When income is higher, you can save extra.

- Needs periodic review: Over time your priorities may change. You might need to divert more to retirement or adjust savings goals.

How Pay Yourself First Compares With Other Budgeting Methods

Understanding how PYF stacks up against other popular methods helps you choose the right strategy or even combine them.

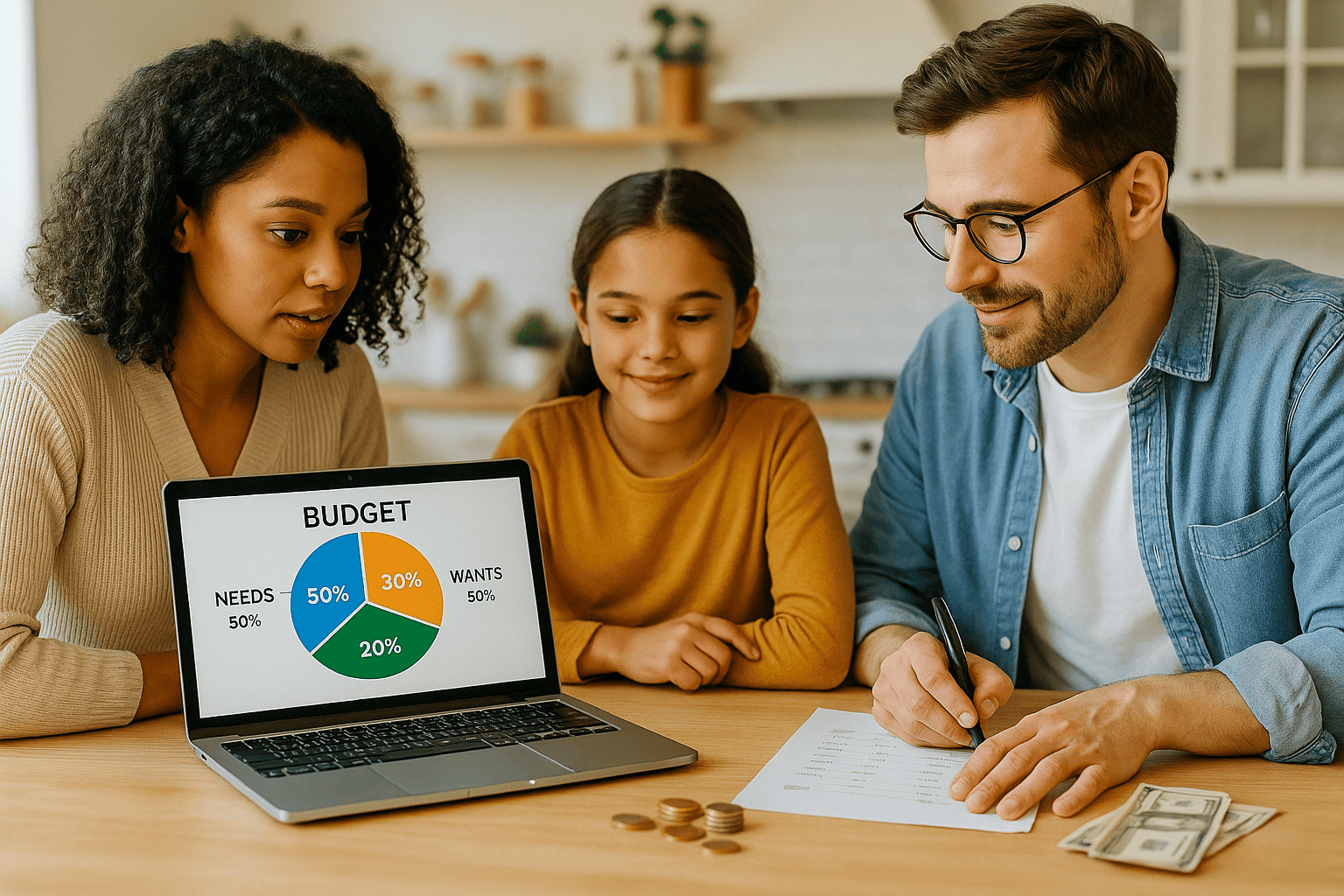

Pay Yourself First vs. 50/20/30 Rule

The 50/20/30 rule divides net income into 50 % needs, 20 % savings and 30 % wants. University of Pennsylvania’s financial wellness program uses it as one of several budgeting strategies. Both approaches emphasise savings but differ in flexibility:

- Savings percentage: PYF lets you choose any percentage. The 50/20/30 rule uses a fixed 20 %. If your goals require more or less savings, PYF is more adaptable.

- Focus on expenses: With 50/20/30, you plan all categories. PYF simply ensures you save first and then forces you to adjust expenses accordingly.

You can combine them: start by saving 20 % (the “20” in 50/20/30) through an automatic transfer, then allocate the remaining 80 % to needs and wants.

Pay Yourself First vs. Zero‑Based Budgeting

In zero‑based budgeting you allocate every dollar of income to a category—expenses, savings or debt—so your monthly income minus expenses equals zero. NerdWallet notes that this method ensures needs and wants are covered and leftover funds can be moved into savingsnerdwallet.com.

PYF is simpler: you save a set amount up front and use the remainder freely. Zero‑based budgeting offers granular control but requires careful tracking of every expense. People who enjoy detailed spreadsheets may prefer zero‑based budgets; those who want a straightforward approach might choose PYF.

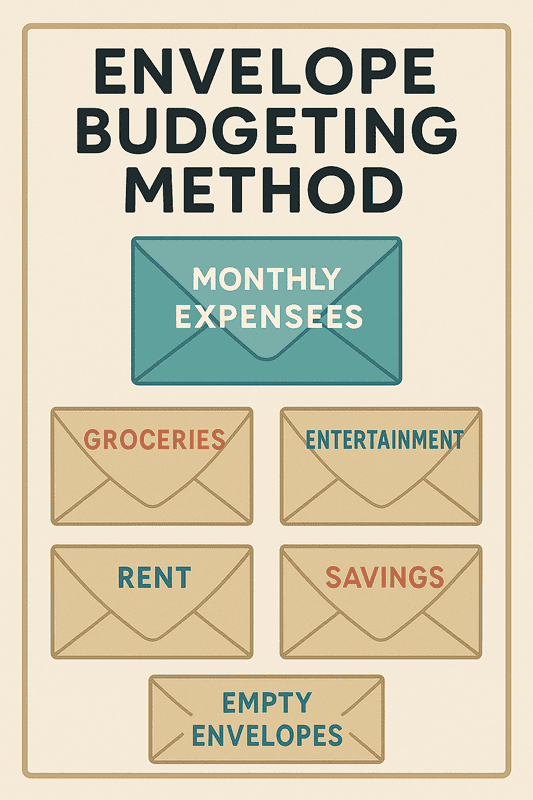

Pay Yourself First vs. Envelope Budgeting

Envelope budgeting (digital or cash) involves dividing income into categories (envelopes) for specific expenses, and once an envelope is empty, you stop spending in that categorynerdwallet.com. PYF focuses first on savings and doesn’t require categorising every expense. Both systems can work together: after paying yourself first, you could use envelopes for remaining spending categories.

Pay Yourself First vs. Pay‑Yourself‑Last (Traditional Budgeting)

Traditional budgeting lists expenses first and saves what’s left over. PYF flips this by prioritizing savings. The main drawback of traditional budgeting is that impulse purchases often eat up potential savings. PYF forces you to build savings before anything else.

Strategies to Supercharge Your Savings

Automate Contributions to Investment Accounts

For long‑term goals, direct part of your PYF contributions into investment accounts such as 401(k)s, IRAs or index funds. These vehicles harness compounding growth. Contribute enough to a workplace retirement plan to get the employer match—it’s essentially free money.

Use Multiple Savings Accounts

Create separate high‑yield savings accounts for each goal (emergency fund, vacation, home down payment). Having distinct buckets reduces the temptation to raid your emergency fund for a holiday. High‑yield accounts, often offered by online banks, pay higher interest than traditional savings accounts.

Review and Increase Contributions Regularly

Whenever you receive a raise or windfall, increase your savings rate. Even an extra 1–2 % can add up over time. Aim to eventually save 20 % or more if possible. Over time, you may find that you can live comfortably on a smaller percentage of your income.

Use Apps and Tools

Budgeting apps like YNAB, Mint, Goodbudget and others help track spending and automate transfers. Some banks also offer tools that automatically round up purchases and transfer the difference to savings. Choose a tool that integrates with your accounts and suits your style.

Combine PYF With Other Methods

You don’t have to stick with a single budgeting approach. Many people use PYF to ensure consistent savings and then manage the remaining expenses with the 50/20/30 rule or envelope budgeting. Experiment to find what works for you.

Case Study: Sarah Implements Pay Yourself First

Background: Sarah is a 28‑year‑old marketing coordinator living in Toronto. Her net monthly income is CAD 3,500. Before adopting the PYF method, she often found herself living paycheck to paycheck, saving sporadically and feeling anxious about emergencies.

Goals: Sarah wanted to build a $5,000 emergency fund within two years, save for a future down payment on a condominium and start contributing to her retirement account.

Implementation:

- Savings rate: Sarah chose a 25 % savings rate (CAD 875 per month)—higher than the basic 20 % because of her ambitious goals.

- Automation: She arranged with her employer to deposit CAD 700 directly into her high‑yield savings account and CAD 175 into a retirement mutual fund each pay period.

- Budget adjustments: After paying herself first, Sarah had CAD 2,625 left. She reviewed her spending and noticed she was spending $300/month on dining out and $120 on streaming services. She reduced dining to $150 and cancelled one streaming subscription, freeing up funds for transportation and groceries.

- Tracking: Sarah used a budgeting app to track expenses and kept envelopes for groceries, rent and discretionary spending. When one envelope was empty, she stopped spending in that category.

Results: After six months, Sarah had saved $5,250—already exceeding her emergency fund goal. She felt more in control of her money, and the habit of saving first became automatic. Her net worth increased, and she enjoyed guilt‑free spending knowing her goals were funded.

Frequently Asked Questions (FAQs)

1. How much should I save using the pay‑yourself‑first method?

There is no universal number. Many people start with 10–20 % of their take‑home pay. The University of Pennsylvania notes that budgeting strategies are flexible and should be customised to your circumstances. If your budget allows, aim for at least 20 %. Increase the percentage when you receive raises or pay off debts.

2. What if my income varies each month?

Variable income makes budgeting tougher. Fidelity suggests basing your savings on your lowest monthly income over the past yearfidelity.com. When you earn more, you can save extra or prepare for leaner months. Create a buffer by maintaining one month’s expenses in a separate account.

3. Should I still track expenses if I pay myself first?

Yes. PYF ensures you save, but tracking helps you stay within the remaining budget. Use a budgeting app or spreadsheet to identify overspending and adjust categories. Combining PYF with a budgeting method such as zero‑based or envelope budgeting can enhance control.

4. Can I use pay‑yourself‑first to pay down debt?

Absolutely. If you have high‑interest debt, allocate part of your “pay yourself” contribution to extra debt payments. This accelerates debt payoff. Once the debt is gone, reallocate that contribution toward savings.

5. Do I need a high income to use this method?

No. Anyone can pay themselves first, regardless of income. Start with a small amount—even $20 per paycheck—and increase gradually. The key is consistency and automation.

6. How does the 80/20 budget relate to pay yourself first?

The 80/20 budget is a simplified version of PYF: you save 20 % and spend 80 %. It’s a starting point for those who want an easy rule of thumb. You can adjust the percentages based on your goals and circumstances.

7. What if unexpected expenses exceed my emergency fund?

Rebuild the fund after using it. Continue paying yourself first, and if possible, temporarily increase your savings rate until the fund is replenished. Consider insurance to manage major risks (health, car, home).

Conclusion

The pay‑yourself‑first method is a straightforward yet powerful way to make saving habitual. By putting yourself at the front of the line, you build a financial safety net, work toward your goals and reduce money stress. The approach can be adapted to any income level and combined with other budgeting strategies. Though it requires planning and discipline, the benefits—financial security, progress toward dreams and peace of mind—are well worth the effort. Ready to start? Decide your savings rate, automate the transfer and watch your financial confidence grow.

Deja una respuesta