Managing your money isn’t just about paying bills on time—it’s about building a fortress around your financial future. In 2026, the landscape of personal finance tools has shifted dramatically. With the closure of Mint last year and the rise of AI-driven financial assistants, finding the right tool to track your net worth and spending has never been more critical.

We have entered a golden age of financial technology (FinTech). The days of manually entering every receipt into a spreadsheet are over. Today’s best budgeting apps connect directly to your bank accounts, categorize your spending with artificial intelligence, and even predict your future cash flow.

But with dozens of options on the App Store and Google Play, how do you choose? We’ve tested over 20 of the most popular budgeting apps to help you find the perfect match for your lifestyle, whether you’re a college student, a debt-crusher, or a high-net-worth investor.

The State of Budgeting in 2026: A Post-Mint World

For over a decade, Mint was the king of free budgeting apps. Its closure sent shockwaves through the personal finance community, leaving millions of users scrambling for alternatives.

This disruption was actually a blessing in disguise. It forced users to re-evaluate what they really needed. Did they need a passive tracker that just showed them where their money went? Or did they need a proactive tool to tell their money where to go?

In 2026, the best apps focus on proactive budgeting. They don’t just report the news; they make the news. They help you:

- Automate Savings: Move money to savings goals before you even see it.

- Detect Subscriptions: Find and cancel that streaming service you haven’t used in 6 months.

- Forecast Cash Flow: Warn you if you’re going to overdraft next week based on your bills.

1. YNAB (You Need A Budget) – Best for Changing Habits

Rating: ⭐⭐⭐⭐⭐ (5/5) Price: $14.99/mo or $99/yr (34-day free trial)

YNAB isn’t just an app; it’s a method. Built around the «Zero-Based Budgeting» philosophy, it forces you to assign every single dollar you earn to a specific category (Rent, Groceries, Savings) before you spend it.

The «Why»

If you are living paycheck to paycheck or drowning in credit card debt, average tracking apps won’t help you. YNAB will. It breaks the cycle by making you plan ahead with money you actually have, not money you expect to have. It treats credit cards like debit cards—when you buy groceries on credit, YNAB immediately moves cash from your «Groceries» envelope to your «Credit Card Payment» envelope.

Deep Dive: Methodology

YNAB follows Four Rules:

- Give Every Dollar a Job: No dollar sits idle.

- Embrace Your True Expenses: Break down large annual bills (like insurance) into monthly savings.

- Roll With The Punches: Overspent on dining out? Move money from the «Vacation» pot. No guilt.

- Age Your Money: Their goal is for you to spend money you earned 30 days ago.

Pros & Cons

✅ Pros:

- Proven Results: The average new user saves $600 in their first two months and over $6,000 in their first year.

- Education: Incredible library of live workshops, videos, and guides.

- Goal Tracking: Very visual progress bars for savings goals.

- Bank Sync: Connects to over 12,000 banks.

❌ Cons:

- Learning Curve: It’s steep. You have to «learn the YNAB way.»

- Price: It’s one of the more expensive options, though users say it pays for itself.

- Manual Work: Requires active participation; not «set it and forget it.»

Best For: Committed budgeters who want to totally transform their relationship with money and crush debt.

2. Monarch Money – The Best All-in-One Dashboard

Rating: ⭐⭐⭐⭐½ (4.5/5) Price: $14.99/mo or $99.99/yr

Rising from the ashes of Mint, Monarch Money has quickly become the favorite for families and couples looking for a premium experience. It was created by the original product team behind Mint, so it feels familiar but significantly more modern and powerful.

The «Why»

It tracks everything: cash flow, investments, real estate (via Zillow integration), and cryptocurrency. It’s the ultimate «financial cockpit» for your life. Unlike Mint, it is ad-free and does not sell your data.

Deep Dive: Features

- Recurring Review: A dedicated view to see all your subscriptions and recurring bills in one calendar.

- Sanity & Rules: Powerful rules engine to rename and categorize transactions automatically.

- Advice: AI-driven advice on how to improve your financial health based on your data.

Pros & Cons

✅ Pros:

- Couples Support: Both partners can log in with their own accounts and view the household finances (a rare feature!).

- Data Import: Seamless migration tool specifically for ex-Mint users.

- Design: Beautiful, clean, and intuitive interface.

❌ Cons:

- Cost: No free tier (but offers a 7-day trial).

- Investment Tools: Good for tracking balances, but doesn’t offer deep fee analysis like Empower.

Best For: Couples, families, and high-earners who want a complete picture of their growing wealth without ads.

3. Simplifi by Quicken – Best Balance of Features and Price

Rating: ⭐⭐⭐⭐ (4/5) Price: $3.99/mo (billed annually)

Simplifi keeps things, well, simple. It allows you to create a personalized spending plan and tracks your banking, credit card, loan, and investment accounts in one place.

The «Why»

It focuses on your «Spending Plan»—calculating how much money you have left to spend after bills and savings. It’s less rigid than YNAB but more proactive than a simple tracker.

Pros & Cons

✅ Pros:

- Watchlists: Set limits on specific categories (e.g., «Spend less than $200 on Uber»).

- Price: Very affordable compared to competitors.

- Reports: excellent monthly spending reports.

❌ Cons:

- Ads: Some cross-promotion of Quicken products.

- No Credit Score: Doesn’t track your credit score natively.

Best For: Essentialists who want a clear view of their finances without spending hours managing it.

4. PocketGuard – Best for Simplicity

Rating: ⭐⭐⭐⭐ (4/5) Price: Free (Basic); Premium $7.99/mo; Lifetime Plan Available

PocketGuard answers one simple question: «Do I have enough money to buy this coffee?»

The «Why»

It connects to your accounts and auto-calculates your «In My Pocket» number—how much disposable income you have left for the day, week, or month after all your bills, subscriptions, and savings goals are accounted for.

Pros & Cons

✅ Pros:

- Simplicity: Very easy to set up and understand at a glance.

- Bill Negotiation: Partnered with services to help negotiate lower rates on cable/internet bills.

- Lifetime Deal: One of the few apps offering a one-time payment option (approx. $79.99).

❌ Cons:

- Limited Depth: Not great for complex financial situations or detailed investment tracking.

- Ads: The free version has upsells.

Best For: Students, recent graduates, and anyone who wants to avoid overspending without complex spreadsheets.

5. Empower (formerly Personal Capital) – Best for Investors

Rating: ⭐⭐⭐⭐⭐ (5/5) Price: Free (Wealth management services fees apply for managed assets)

If you have already mastered your monthly budget and are focused on growing your net worth, Empower is the industry standard.

The «Why»

It’s less of a budgeting tool and more of a portfolio analyzer. It tells you if you are paying too much in fees on your 401(k), how your asset allocation compares to the S&P 500, and whether you are on track to retire at 65.

Deep Dive: Investment Tools

- Fee Analyzer: Scanning your mutual funds to see how much you are losing to expense ratios.

- Retirement Planner: Running thousands of simulations (Monte Carlo) to see the probability of your money lasting.

Pros & Cons

✅ Pros:

- Investment Analysis: Incredible depth on your portfolio’s health.

- Retirement Planner: Best-in-class simulator for 2026.

- Totally Free: The robust dashboard costs $0.

❌ Cons:

- Sales Calls: You may get calls from their advisors pitching managed services (you can decline).

- Budgeting is Weak: The budgeting features are very basic compared to YNAB.

Best For: High-income earners and investors focused on net worth > cash flow.

6. Honeydue – Best for Couples

Rating: ⭐⭐⭐⭐ (4/5) Price: Free

Money is a leading cause of relationship stress. Honeydue aims to fix that by letting partners track their balances together.

The «Why»

It allows you to link joint and individual accounts. You can choose how much your partner sees (e.g., share the balance but not every transaction).

Pros & Cons

✅ Pros:

- Totally Free: No subscription fees.

- Chat: Comment on specific transactions (e.g., «What was this charge at Target?»).

- Bill Reminders: Sends notifications to both partners when a bill is due.

❌ Cons:

- Mobile Only: No desktop web app.

- Bugs: Syncing can sometimes be glitchy compared to paid apps.

Best For: Couples just starting to merge their finances.

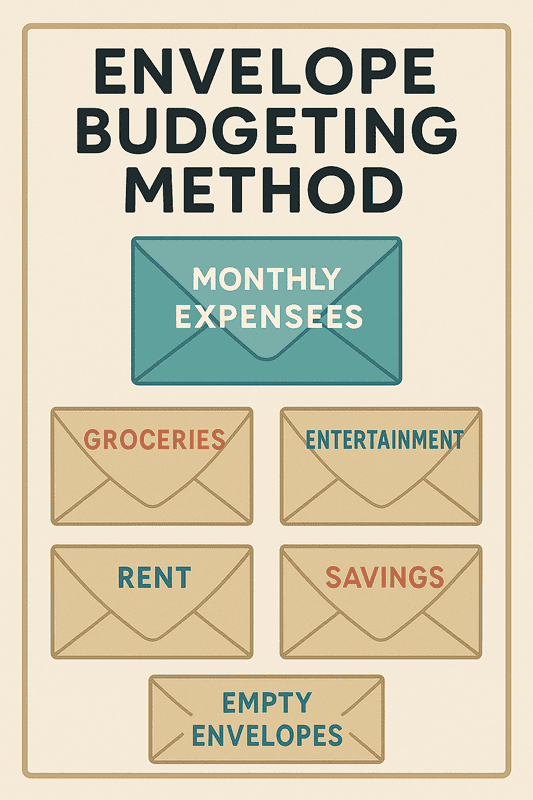

7. Goodbudget – Best for Envelope Budgeting

Rating: ⭐⭐⭐ (3.5/5) Price: Free (10 envelopes); Plus $8/mo

Digital envelope budgeting for those who prefer a classic approach without linking bank accounts.

The «Why»

Based on the Grandpa’s envelope system. You put money into digital «envelopes» (Groceries, Gas, Rent). When the envelope is empty, you stop spending.

Pros & Cons

✅ Pros:

- Security: Since you don’t link bank accounts, there’s zero risk of data breach.

- Discipline: Manual entry forces you to feel every transaction.

- Free Tier: Generous enough for simple budgets.

❌ Cons:

- Manual Entry: You have to type in every coffee you buy.

- Outdated UI: The interface feels a bit 2015.

Best For: Privacy-focused users and envelope method purists.

8. EveryDollar – Best for Dave Ramsey Fans

Rating: ⭐⭐⭐⭐ (4/5) Price: Free (Manual); Premium $12.99/mo (Bank Sync)

Created by financial guru Dave Ramsey, this app is built for the «Baby Steps» method.

The «Why»

It’s strictly zero-based budgeting. It’s simple, clean, and integrates with Ramsey’s content.

Pros & Cons

✅ Pros:

- Baby Steps Integration: Tracks your progress on the 7 Baby Steps.

- Clean UI: Very easy to use.

❌ Cons:

- Expensive: The bank sync is pricey compared to competitors.

- Pushy: Pushes other Ramsey products.

Best For: Devout followers of the Dave Ramsey plan.

9. Rocket Money – Best for Cutting Costs

Rating: ⭐⭐⭐⭐ (4/5) Price: Free (limited); Premium (Pay What You Want, $3-$12/mo)

Formerly Truebill, Rocket Money is famous for cancelling unwanted subscriptions.

The «Why»

It scans your accounts for recurring charges and offers to cancel them for you. It also negotiates bills (taking a 40% cut of the savings).

Pros & Cons

✅ Pros:

- Subscription Management: The best in the business.

- Credit Score: Includes credit monitoring.

- Autopilot Savings: Smart savings transfers.

❌ Cons:

- Bill Negotiation Fee: 40% of savings is steep.

- Budgeting: Good, but not as detailed as YNAB.

Best For: People who suspect they are wasting money on forgotten subscriptions.

10. Oportun (formerly Digit) – Best for Mindless Saving

Rating: ⭐⭐⭐ (3.5/5) Price: $5/mo

Oportun is an AI-powered savings app that analyzes your spending and automatically transfers small amounts to savings every day.

The «Why»

«Set it and forget it.» It moves money you won’t miss.

Pros & Cons

✅ Pros:

- Effortless: You literally do nothing.

- Overdraft Protection: Pauses transfers if balance is low.

❌ Cons:

- Monthly Fee: Paying $5/mo to save money feels counterintuitive for some.

Best For: People who struggle to save even $1 on their own.

Buyer’s Guide: How to Choose in 2026?

Don’t just pick the prettiest icon. Ask yourself these 3 questions:

1. What is your primary goal?

- «Get out of debt» -> Go with YNAB. You need a tool that acts like a strict coach.

- «Track my wealth» -> Empower or Monarch. You need a dashboard, not a coach.

- «Stop wasting money» -> Rocket Money or PocketGuard. You need a detective.

2. How much time do you have?

- «I love data» -> YNAB or Tiller (Spreadsheets).

- «I have 5 minutes a week» -> Simplifi or Rocket Money.

3. Are you willing to pay?

Free apps like Goodbudget or Empower are great, but paid apps like YNAB often result in saving far more than the subscription cost. Think of it as hiring a financial assistant for $10/month.

Methodologies Explained

- Zero-Based Budgeting: Income – Expenses = $0. Every dollar has a job. (Used by: YNAB, EveryDollar).

- Envelope System: Cash based allocation. When the envelope is empty, spending stops. (Used by: Goodbudget, Mvelopes).

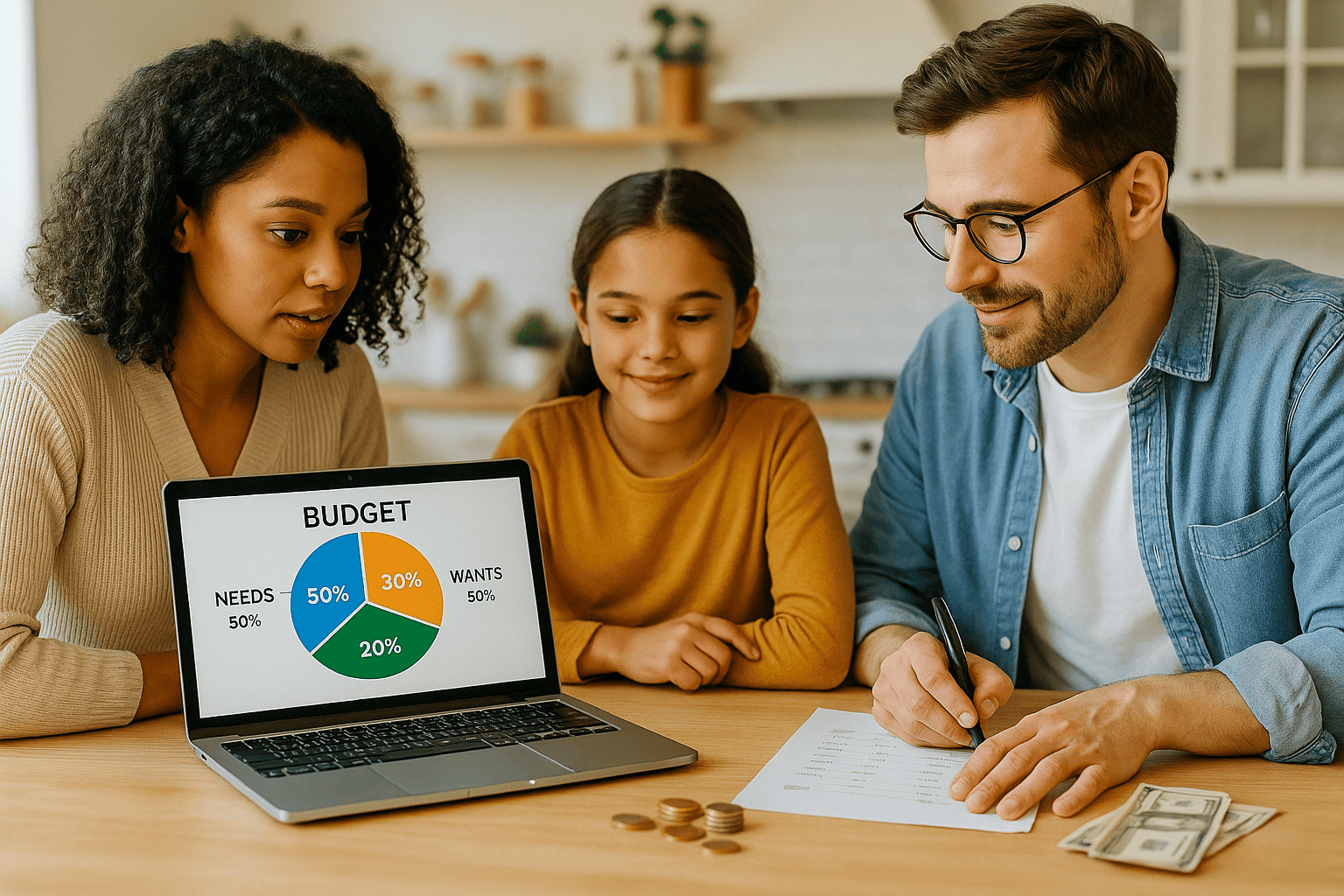

- 50/30/20 Rule: 50% Needs, 30% Wants, 20% Savings. (Supported by: Monarch, Simplifi).

Frequently Asked Questions (FAQ)

Q: Are these apps safe to link to my bank? A: Yes. All the apps listed here use bank-level encryption (256-bit AES) and typically use third-party aggregators like Plaid, MX, or Yodlee. They do not store your bank login credentials directly. They have «read-only» access, meaning they can see transactions but cannot move money out of your account.

Q: Can I budget for free in 2026? A: Absolutely. Goodbudget and the free version of PocketGuard are excellent. Empower is free for wealth tracking. You can also use Google Sheets (we have a template for that!).

Q: What happened to Mint? A: Mint shut down in early 2024. Most users migrated to Credit Karma (which acquired it) or switched to Monarch Money for a similar, albeit paid, experience.

Q: Which app connects to the most banks? A: YNAB and Monarch Money utilize multiple aggregators (Plaid, MX, Finicity), giving them the highest success rate for reliable connections.

Q: Can I use these apps outside the US? A: YNAB and PocketGuard work in many countries (Canada, UK, EU). Monarch is currently expanding. Always check if your specific local banks are supported before subscribing.

Comparison Table: 2026 Features

| App | Best For | Price | Bank Sync? | Couples? |

|---|---|---|---|---|

| YNAB | Strict Budgeting | $$ | Yes | Yes (Shared) |

| Monarch | Net Worth & Family | $$ | Yes | Yes (Shared) |

| Simplifi | Balance | $ | Yes | No |

| PocketGuard | Daily Spending | Free / $ | Yes | No |

| Empower | Investing | Free | Yes | No |

| Honeydue | Couples | Free | Yes | Yes |

| Goodbudget | Envelopes | Free / $ | No | Yes (Sync) |

| EveryDollar | Dave Ramsey Fans | Free / $$ | $$ Only | Yes |

| Rocket Money | Subscriptions | Free / $ | Yes | No |

Final Verdict

For most users in 2026, Monarch Money offers the best balance of features if you want a complete financial picture, replacing spreadsheets and multiple apps. However, YNAB remains the undeniable king for those who need to get out of debt aggressively and change their financial habits permanently.

Ready to start? Download one today and take the first step toward master your money.

Disclaimer: WalletFortify is an independent publisher and comparison service, not an investment advisor. We may earn a commission from affiliate links in this article. We only recommend tools we trust and verify.

Deja una respuesta