Introduction

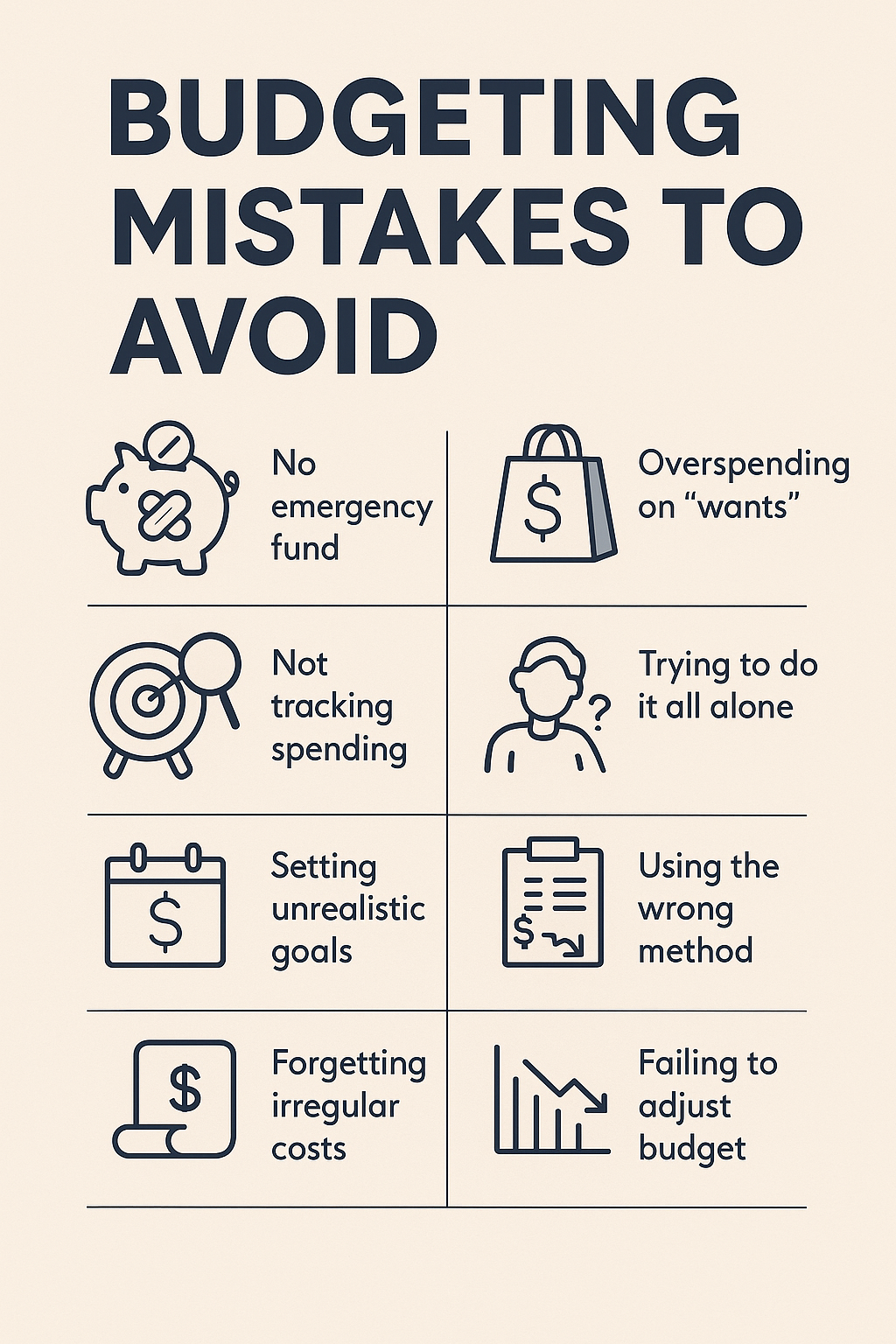

Creating a budget is one of the most powerful things you can do for your financial health. A good budget helps you balance your income and spending, build savings and avoid debt. Yet many people find that despite their best intentions, budgets often go off the rails. Unexpected expenses, overspending on dining out or setting unrealistic targets can undermine even the most carefully crafted plan. SoFi’s financial education site points out that a budget can help you reach your goals but it often goes awry when common pitfalls aren’t addressedsofi.com.

In this article we’ll identify the most frequent budgeting mistakes and provide practical solutions for each. Whether you’re new to budgeting or simply looking to refine your approach, understanding these missteps will help you create a plan that works for your lifestyle.

Why Budgets Fail

Before diving into specific mistakes, it’s important to recognize why budgets fail. Financial educators at the University of Pennsylvania emphasize that there is no one‑size‑fits‑all budget; a budget should be tailored to your income, goals and spending patterns. People sometimes adopt a method that doesn’t suit them or become frustrated when expenses don’t fit neatly into categories. Sometimes a single budget category—like food—swings wildly from month to month, making it hard to stick to a plan. Or people treat their budget as inflexible, failing to adjust as life changes. Budgets can also collapse under the weight of unrealistic expectations; a plan that demands you save half your income when you’re living paycheck to paycheck is bound to fail.

Recognizing that your budget is a living document—one you can adjust as needed—is the first step toward success.

Mistake 1: Not Having a Budget at All

The Problem: Some people avoid budgeting entirely, thinking it’s too tedious or time‑consuming. They assume they can keep track of their finances mentally or simply avoid looking at them. SoFi notes that failing to create and follow a budget means you might not save enough for the future and could wind up overspendingsofi.com.

The Fix: Start simple. Your first budget doesn’t need dozens of categories. List your monthly net income, essential expenses (housing, food, transportation), debt payments and a small savings amount. Then track your spending for a month to see where your money actually goes. Use a budgeting app or spreadsheet for convenience. As you get comfortable, refine your categories and savings goals.

Mistake 2: Not Tracking Your Spending

The Problem: It’s impossible to know whether you’re within your budget if you don’t track your expenses. SoFi’s article explains that failing to track spending can cause you to blow past category limits and leave no money for other needssofi.com. People often underestimate how much they spend on small, frequent purchases like coffee or takeout.

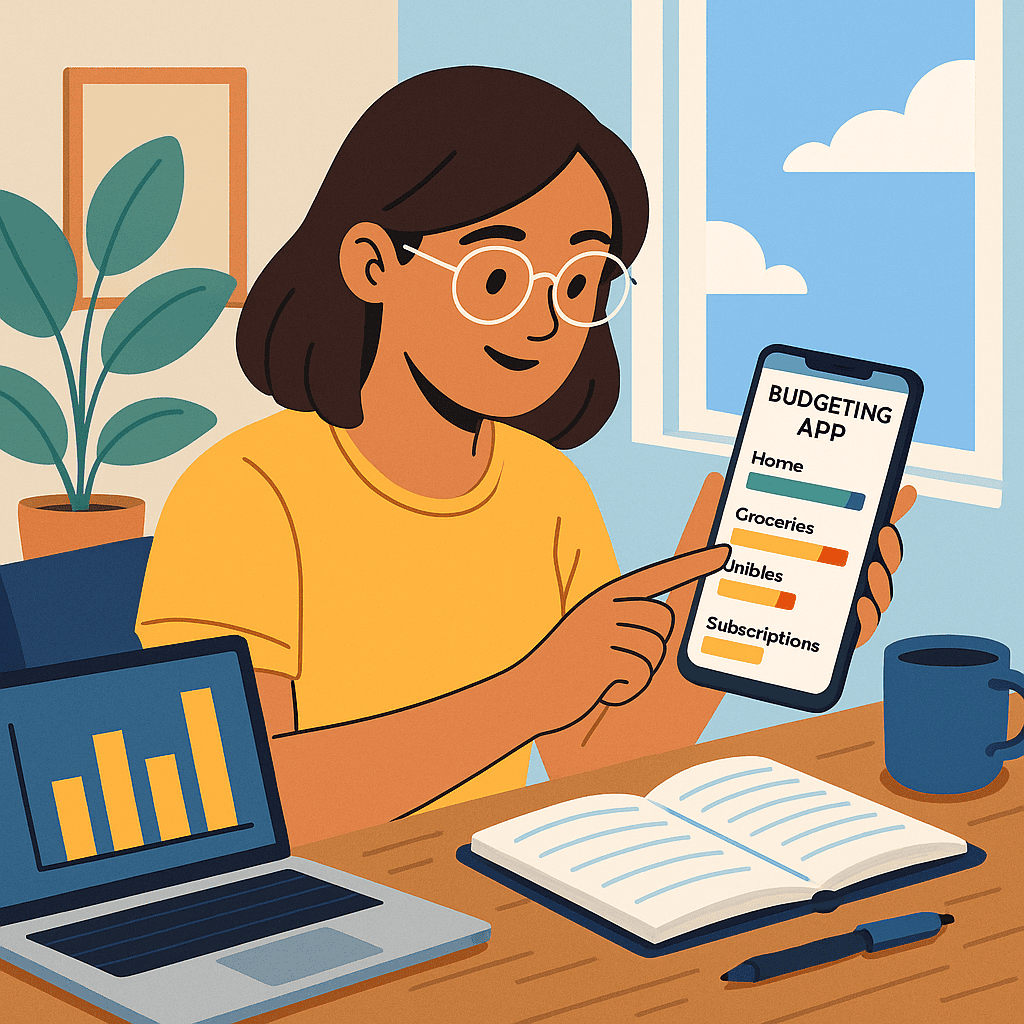

The Fix: Choose a tracking method that fits your style. Many budgeting apps automatically import transactions from your bank accounts and categorize them. If you prefer manual tracking, keep receipts or enter expenses into a spreadsheet daily. Reviewing your spending regularly—weekly or bi‑weekly—lets you catch overspending early and adjust your budget before the month ends.

Mistake 3: Skipping Emergency Savings

The Problem: A budget can quickly collapse if you don’t have an emergency fund. SoFi recommends saving three to six months’ worth of expenses for medical emergencies, car repairs and job losssofi.com. Without this cushion, you may have to raid other budget categories or go into debt when unexpected bills arisesofi.com.

The Fix: Start by setting up a separate savings account and automate a small monthly transfer—$25 or $50—to build your emergency fund. Increase the amount whenever you receive a raise or bonus. Treat emergency savings as a non‑negotiable line item in your budget. If you use budgeting methods like pay yourself first, allocate part of your savings to the emergency fund before spending on anything else.

Mistake 4: Ignoring Cheaper Alternatives

The Problem: Some people stick to expensive habits without exploring cheaper options. SoFi suggests that you might free up cash by swapping a pricey gym membership for a more affordable one, shopping around for insurance or negotiating a medical billsofi.com. Failing to consider alternatives can lock you into high spending patterns.

The Fix: Regularly evaluate your recurring expenses. Compare prices for insurance, phone plans or streaming services. Look for free or lower‑cost substitutes for leisure activities—a community fitness program instead of a boutique gym, library books instead of buying new. Negotiating bills or switching providers can save you hundreds each year.

Mistake 5: Believing You Can’t Have Fun While on a Budget

The Problem: Some view budgeting as a killjoy and assume that to be financially responsible they must forego all pleasures. SoFi counters this misconception by pointing out that budgets include discretionary funds for activities like movies or weekend getawayssofi.com. When people deny themselves entirely, they often rebel later with a spending binge.

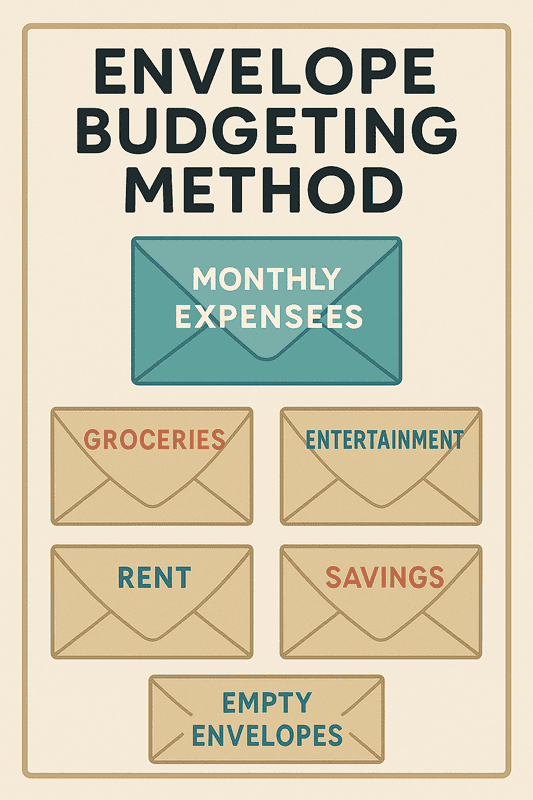

The Fix: Build fun into your budget. Allocate a reasonable amount each month to entertainment or hobbies. It might be a “fun money” envelope or category in your app. As long as you stay within that limit, you can enjoy yourself guilt‑free. Celebrate milestones—such as paying off a credit card or reaching a savings goal—with a small reward.

Mistake 6: Saving for Too Many Things at Once

The Problem: Ambition is admirable, but trying to save for every possible goal simultaneously can leave you feeling stretched thin and unable to see progress. SoFi notes that when you try to save for too many things at once, it’s easy to feel stucksofi.com.

The Fix: Prioritize your goals. Categorize them as needs (e.g., emergency fund, debt repayment) and wants (e.g., a new car, vacation). Focus on one or two top priorities until they’re adequately funded. Once you hit your emergency fund target or pay off a debt, you can move that contribution toward the next goal. This way you see progress faster and stay motivated.

Mistake 7: Not Adjusting for Variable Expenses

The Problem: Some expenses—like groceries, utilities or gas—fluctuate from month to month. If you base your budget on last month’s costs and don’t adjust when they rise (e.g., due to inflation), you can overspend. SoFi warns that not accounting for fluctuating expenses can derail your budget, especially during periods of high inflationsofi.com.

The Fix: Estimate variable expenses using averages from the last three to six months. Review these categories each month and adjust your budget if you notice a consistent increase. Build a buffer into variable categories so you’re prepared for occasional spikes. For rising costs (like food or gas), look for ways to reduce consumption—plan meals, shop sales, carpool or use public transit.

Mistake 8: Forgetting One‑Time and Irregular Expenses

The Problem: Annual subscriptions, wedding gifts, car maintenance and holiday shopping aren’t monthly but they do occur regularly. SoFi notes that failing to account for one‑time expenses can blow up your budget when a bill arrives unexpectedlysofi.com.

The Fix: Create sinking funds for irregular expenses. Estimate the annual cost of each and divide by 12 to determine a monthly contribution. For example, if you typically spend $800 annually on holiday gifts, save about $67 per month in a dedicated envelope or subaccount. When the expense arrives, you’ll have the money ready. Some budgeting apps allow you to set these sinking funds and automate contributions.

Mistake 9: Setting an Unrealistic Budget

The Problem: Overly optimistic budgets can be as harmful as no budget at all. SoFi warns that allocating a high percentage of your income to a single goal (e.g., saving 20 % toward a home down payment) can lead to credit card debt if you underestimate everyday expensessofi.com.

The Fix: Base your budget on reality. Review your past three months of expenses to establish reasonable estimates. If you want to increase savings, do so gradually—raise your savings rate by one or two percentage points at a time. Your budget should challenge you but still be achievable. Adjust as your income or expenses change.

Mistake 10: Using the Wrong Budget Method for Your Personality

The Problem: A budgeting system that works for your friend might not work for you. SoFi emphasizes that there is no one‑size‑fits‑all strategy; clinging to a method that doesn’t fit your lifestyle is a mistakesofi.com. For example, a detailed zero‑based budget might overwhelm you, while a simpler 50/20/30 approach could feel just right.

The Fix: Experiment with different methods and tools. Try envelope budgeting, zero‑based budgeting, the 50/20/30 rule or pay yourself first. Choose one that you find sustainable. Budgeting apps offer free trials; test a few to see which aligns with your habits. Remember that you can mix methods—for instance, pay yourself first to save 20 %, then use envelopes for discretionary spending.

Mistake 11: Not Reviewing Your Budget Regularly

The Problem: Budgets aren’t static. Income changes, goals shift and life throws curveballs. If you set a budget and never revisit it, it may become irrelevant.

The Fix: Schedule a regular money date with yourself (or your partner) to review your budget. This can be weekly, bi‑weekly or monthly. During the review, compare your actual spending to your budget, assess whether categories need adjusting and celebrate progress toward goals. Regular check‑ins help keep your budget aligned with reality and maintain your motivation.

Mistake 12: Not Getting Buy‑In From a Partner or Family

The Problem: If you share finances with a partner or family but only one person handles the budget, miscommunication can lead to friction and overspending. Without shared goals and transparency, your budget may fail.

The Fix: Involve everyone affected by the budget. Discuss shared goals, agree on spending categories and decide together how much to allocate to savings and fun. Use joint budgeting tools that sync across devices so both partners can see envelope balances or category spending. Schedule periodic financial meetings to stay aligned.

Mistake 13: Ignoring Debt in Your Budget

The Problem: Some budgets focus on everyday expenses but overlook debt payments. Ignoring debt means it persists longer and costs more in interest.

The Fix: Include minimum debt payments in your budget. If possible, allocate extra funds toward high‑interest debt using the snowball (smallest balance first) or avalanche (highest interest first) method. Reducing debt frees up future cash flow and reduces stress.

Mistake 14: Not Planning for Income Taxes and Payroll Deductions

The Problem: Freelancers, gig workers or people with multiple income streams sometimes forget to set aside money for taxes. Employees may not factor in payroll deductions for benefits, leaving less take‑home pay than they expect.

The Fix: Know your net income. If you’re self‑employed, set aside a percentage (often 25–30 %) of your income for taxes in a separate account. Employees should review pay stubs to understand deductions for health insurance, retirement contributions and taxes. Base your budget on net—not gross—income.

Mistake 15: Relying Only on Memory and Not Using Tools

The Problem: Trying to remember every transaction and category is nearly impossible. Without tools, you might forget expenses, misestimate balances and feel overwhelmed.

The Fix: Use a budgeting tool that fits your preferences. Apps like YNAB and Goodbudget support detailed zero‑based or envelope budgetsnerdwallet.com. Mint and PocketGuard automatically import transactions and help you monitor spending. Spreadsheets work if you prefer a custom solution. Even a simple notebook is better than relying on memory.

Mistake 16: Failing to Reward Yourself

The Problem: Budgeting can feel like a grind if you never celebrate wins. Without small rewards, you might lose motivation and abandon your budget.

The Fix: Build rewards into your plan. For example, after hitting a savings milestone or paying off a credit card, treat yourself to dinner or a new book—within your budget, of course. Rewards reinforce positive behavior and make budgeting sustainable.

Case Study: Turning Budget Mistakes Into Success

Background: Kevin is a 29‑year‑old teacher living in Madrid. He attempted budgeting multiple times but kept abandoning his plans. He decided to identify his mistakes and fix them.

Kevin’s Mistakes:

- He didn’t track his spending and consistently underestimated how much he spent on eating out (Mistake 2).

- He had no emergency fund (Mistake 3), so any car repair forced him onto his credit card.

- His budget was unrealistic; he tried to save 30 % of his income while paying student loans (Mistake 9).

- He never adjusted for variable expenses like higher utility bills in winter (Mistake 7).

Fixes and Results:

- Tracking: Kevin started using a budgeting app that linked to his bank account and categorized his transactions automatically. He quickly noticed that he was spending €250 per month on takeout—more than he thought.

- Emergency savings: He opened a separate savings account and set up an automated €75 transfer each payday. After six months, he had €450 set aside.

- Realistic budget: Kevin reduced his savings goal to 15 % and allocated €50 per month toward extra debt payments. He planned to increase savings after paying off a small student loan.

- Adjusting variable expenses: He reviewed the past year’s utility bills and budgeted a winter buffer of €30 extra per month to cover higher heating costs.

After a year, Kevin felt in control of his finances for the first time. He avoided new credit card debt, funded his emergency account and slowly increased his savings rate as his circumstances improved.

Frequently Asked Questions (FAQs)

- Why does a budget fail? Budgets fail when they’re unrealistic, not tracked, or don’t account for irregular expenses. Using a method that doesn’t fit your personality or failing to adjust for changes can also derail your plansofi.com.

- How much should I save in an emergency fund? SoFi recommends saving three to six months’ worth of expensessofi.com. Start with a small, automatic monthly contribution and build up over time.

- How often should I review my budget? Review your budget at least monthly. Weekly or bi‑weekly check‑ins help catch overspending early and ensure you’re on track.

- What is a sinking fund? A sinking fund is a savings method for irregular or one‑time expenses. You set aside a small amount each month so that when the expense arrives, you have the money readysofi.com.

- Can I combine budgeting methods? Yes. You might use the pay‑yourself‑first method for savings, envelope budgeting for discretionary spending and zero‑based budgeting for overall planning. There is no universal method; choose what works for yousofi.com.

Conclusion

Budgeting doesn’t have to be restrictive or complicated. By identifying and addressing common mistakes—such as failing to track expenses, skipping emergency savings or using the wrong budgeting method—you can create a plan that supports your goals and adapts to your life. Remember that budgets are living documents. Tailor yours to your needs, adjust it as circumstances change and don’t be afraid to experiment with different methods or tools. The right approach, combined with regular review and a bit of flexibility, can transform budgeting from a chore into a powerful tool for financial freedom.

Deja una respuesta