Introduction

Dreaming of buying your first home, upgrading your car or taking a once‑in‑a‑lifetime trip? Big purchases can be exciting but also intimidating. The price tag on a down payment, new vehicle or extended vacation may seem daunting. Without a plan, it’s easy to postpone your dreams indefinitely or fall into debt trying to achieve them. The good news is that with the right strategies, you can turn those dreams into reality.

Financial educators stress that saving for large purchases is not about luck—it’s about planning. The California Department of Financial Protection and Innovation (DFPI) recommends identifying big purchases and estimating their costs, paying yourself first, setting attainable goals, adopting budgeting rules like the 50/20/30 guideline, using high‑interest savings accounts and leveraging technologydfpi.ca.gov. In this article, we’ll expand on these strategies and show how to tailor them to buying a house, a car or financing a major vacation.

Step 1: Identify the Purchase and Estimate the Cost

Before you begin saving, define exactly what you’re working toward and how much it will cost. DFPI suggests researching the purchase thoroughly to obtain an accurate estimate and account for variables like inflation and future price changesdfpi.ca.gov.

Buying a House

- Home price and down payment: Determine the price range for houses in your desired location. Most conventional mortgages require a down payment of 10–20 %, though there are programs that allow smaller amounts. Larger down payments reduce your monthly mortgage and may eliminate private mortgage insurance (PMI).

- Closing costs: In addition to the down payment, factor in closing costs (usually 2–5 % of the purchase price). These include lender fees, appraisal, title insurance and taxes.

- Maintenance and insurance: Homeownership also includes ongoing expenses like property taxes, insurance, utilities and repairs.

Buying a Car

- Vehicle price: Decide between new or used and consider the make and model. Research sticker prices, resale values and reliability ratings.

- Fees and taxes: Include sales tax, registration, insurance and any dealership fees.

- Maintenance and fuel: Estimate annual maintenance, fuel costs and potential repair expenses.

Planning a Vacation

- Destination and accommodation: Research flights, accommodations and transportation at your destination. Prices can vary by season and location.

- Daily expenses: Include meals, excursions, insurance and souvenirs. Overestimate slightly to cover unexpected costs.

- Exchange rates and fees: If traveling internationally, factor in currency conversion fees and fluctuations.

After calculating the total cost, break it down into a savings goal (e.g., $20,000 for a home down payment). Knowing the target helps determine how much you need to save each month.

Step 2: Pay Yourself First

Once you know your goal, adopt the pay yourself first strategy—saving before spending. DFPI emphasizes setting aside a portion of each paycheck before paying billsdfpi.ca.gov. Automating this process ensures consistency and removes the temptation to spend the money elsewheredfpi.ca.gov.

For example, if you need $12,000 for a car in two years, divide $12,000 by 24 months. You’ll need to save $500 per month. Set up an automatic transfer from your checking to a dedicated savings account on payday for that amount. Treat it like a non‑negotiable expense.

Start small if necessary. Even saving $50 per paycheck builds momentum. Increase the amount as your financial situation improvesdfpi.ca.gov.

Step 3: Set SMART Goals

The DFPI encourages using SMART goals—Specific, Measurable, Achievable, Relevant and Time‑bound—to make saving more tangibledfpi.ca.gov.

- Specific: State the exact purchase and cost (e.g., “Save $30,000 for a home down payment”).

- Measurable: Track progress by monitoring your account balance and the percentage of the goal achieved.

- Achievable: Set a realistic savings timeline based on your income and expenses. Saving $30,000 in 12 months may be unrealistic for most people; 36 months might be feasible.

- Relevant: Ensure the goal aligns with your priorities (e.g., buying a home vs. leasing a nicer apartment).

- Time‑bound: Give yourself a deadline, which motivates you to stay on track.

Write down your goals and keep them visibledfpi.ca.gov—on your fridge, vision board or smartphone—so they remain top of mind. Review your goals regularly and adjust if neededdfpi.ca.gov.

Step 4: Use a Budgeting Method That Works for You

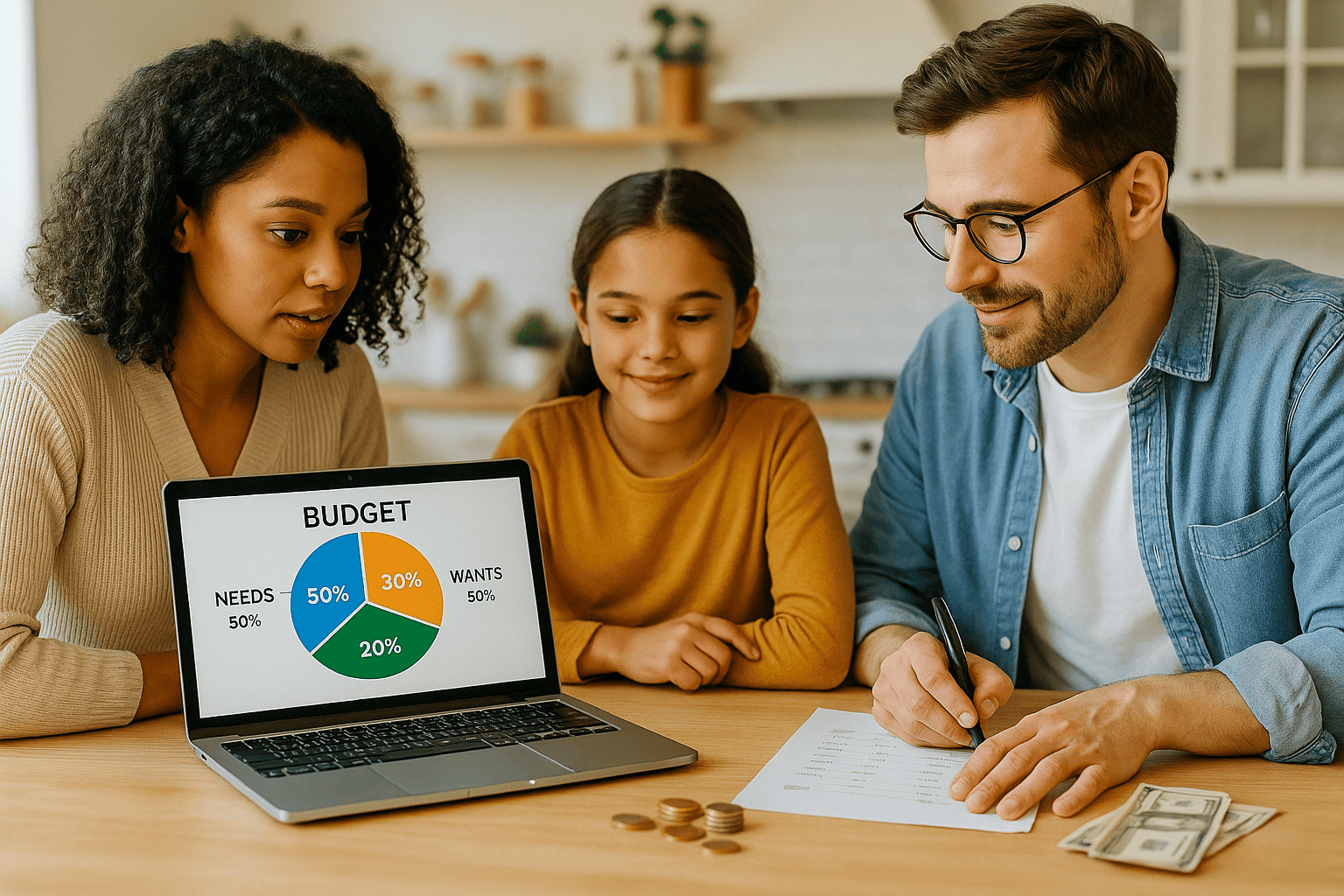

To free up money for big purchases, you need to control your spending. The 50/20/30 rule recommended by DFPI allocates 50 % of your income to necessities, 20 % to savings and 30 % to discretionary spendingdfpi.ca.gov. This rule ensures consistent saving while allowing some flexibility for fun.

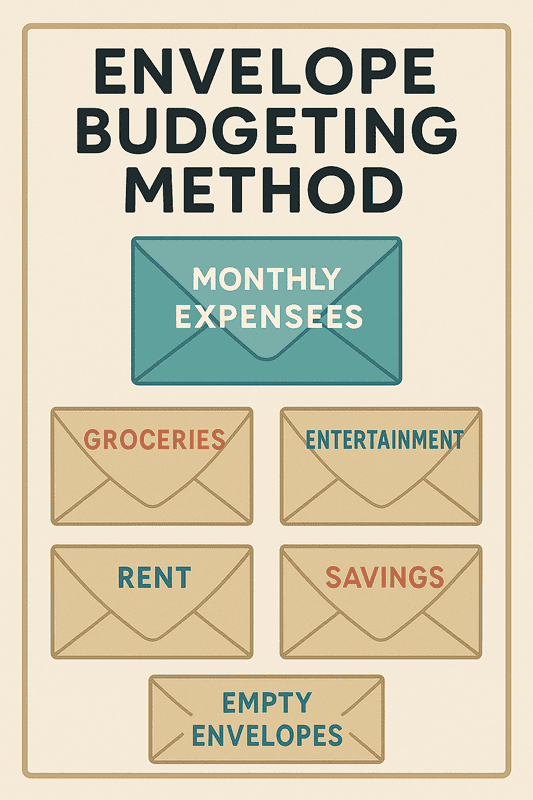

If the 20 % savings portion isn’t feasible, adjust by trimming discretionary spending or increasing incomedfpi.ca.gov. Alternatively, try other budgeting methods:

- Zero‑based budgeting: Allocate every dollar of income to a category (expenses, savings, debt). Money left at the end of the month goes toward savings. Apps like YNAB or Goodbudget can helpnerdwallet.com.

- Envelope budgeting: Divide spending money into envelopes (physical or digital) for categories like groceries, entertainment and travel. Once an envelope is empty, stop spending in that category.

- Pay yourself first budgeting: Dedicate a set percentage of income to savings before budgeting the rest, as described above.

Choose the method that fits your personality and lifestyle. It’s a mistake to stick with a budgeting system that doesn’t work for yousofi.com.

Step 5: Open a Dedicated, High‑Interest Savings Account

DFPI advises opening a high‑interest savings account to earn more on your savingsdfpi.ca.gov. Not all savings accounts are created equal; online banks often offer higher interest rates than traditional brick‑and‑mortar banks. When selecting an account:

- Compare interest rates: Even a small difference in annual percentage yield (APY) can significantly impact your savings over time. For example, a 4 % APY on $10,000 yields about $400 in interest after one year.

- Check fees and requirements: Some high‑yield accounts require minimum balances or limit monthly withdrawals. Make sure the account fits your needsdfpi.ca.gov.

- Set up automatic transfers: Automate deposits into this account so you’re consistently adding to your savings without manual effort.

Consider opening separate subaccounts or “savings buckets” for each goal (e.g., one for your car and one for your vacation) to avoid accidentally spending funds on the wrong goal.

Step 6: Leverage Technology

In the digital age, apps and online platforms can accelerate your saving efforts. DFPI recommends leveraging technology to monitor spending, invest spare change and automate savingdfpi.ca.gov. Examples include:

- Round‑up apps: Apps like Acorns or Qapital round up your purchases to the nearest dollar and deposit the difference into a savings or investment account.

- Budgeting apps: Apps such as Mint, YNAB and PocketGuard track spending and help identify categories to cut back.

- Automated transfers: Many banks allow you to schedule recurring transfers to your savings account or schedule a daily “sweep” of leftover money into savings.

Using technology reduces the friction of saving and provides insights into your progress.

Saving Strategies for Specific Purchases

House: Down Payment and Closing Costs

Saving for a house is often the largest goal many people pursue. Here are strategies:

- Determine the target amount: Estimate a down payment of 10–20 % of your desired home price plus closing costs.

- Take advantage of tax‑advantaged accounts: In some jurisdictions, first‑time homebuyer savings accounts or tax credits exist. Research programs in your area.

- Reduce high‑interest debt first: Paying down credit cards improves your debt‑to‑income ratio, making you more attractive to lenders.

- Generate extra income: Consider side gigs or freelancing to accelerate your savings. Even a few hundred extra dollars per month can drastically shorten the timeline.

- Consider gifts and grants: Some government programs and family members may contribute to your down payment. Understand the rules regarding gifts for down payments.

Car: Purchase vs. Financing

Cars depreciate quickly, so evaluate whether you should save the full amount or finance a portion.

- Set a budget for your car: Determine how much you can afford per month, considering insurance, fuel and maintenance.

- Save for a down payment: Even if you finance, a down payment reduces the principal and lowers monthly payments.

- Weigh new vs. used: New cars come with warranties but depreciate faster. Certified pre‑owned (CPO) vehicles can offer a balance between cost and reliability.

- Shop for loan rates: Pre‑qualify with banks or credit unions to compare interest rates before visiting dealerships.

- Plan for replacement: Cars wear out. Start saving for your next car immediately after purchasing your current one by continuing to make “car payments” to yourself.

Vacation: Plan Ahead and Prepay

Vacations are more enjoyable when they don’t follow you home in the form of credit card debt. To save effectively:

- Research and book early: Flights and accommodations are often cheaper when booked months in advance.

- Use a vacation savings account: Deposit a set amount each paycheck. Many banks let you nickname accounts (e.g., “Hawaii 2026”).

- Look for flexible payment options: Some travel providers allow you to pay in installments without interest. Only use these if you’re confident you can pay on time.

- Travel off‑peak: Prices drop in shoulder seasons or during mid‑week travel. Consider alternate destinations with similar experiences but lower costs.

- Use rewards and cash‑back credit cards responsibly: Earning points on everyday purchases can offset travel costs. However, pay your balance in full each month to avoid interest.

Case Study: Saving for a Home, Car and Vacation

Background: Ana and Roberto are a married couple living in Ceuta, Spain. They earn a combined net income of €4,000 per month. They want to buy a €200,000 home in five years, replace their aging car in three years and take a celebratory trip to Japan in two years.

Step 1: Estimate costs

- Home goal: 20 % down payment (€40,000) plus €10,000 for closing costs = €50,000.

- Car goal: A reliable used car costing €15,000; they plan to pay cash.

- Vacation goal: Estimated €6,000 including flights, accommodation, food and activities.

Step 2: Pay themselves first

They decide to save €800 per month toward their goals. They automate transfers on payday: €400 to the house fund, €250 to the car fund and €150 to the vacation fund.

Step 3: SMART goals

- House: “Save €50,000 for a home down payment and closing costs by June 2030.”

- Car: “Save €15,000 for a car by May 2028.”

- Vacation: “Save €6,000 for a Japan trip by April 2027.”

Step 4: Budgeting method

Using the 50/20/30 rule, they allocate 50 % (€2,000) to necessities (rent, utilities, groceries), 20 % (€800) to savings (house, car, vacation), and 30 % (€1,200) for discretionary spending. When necessary, they temporarily reduce dining out to stay within the 20 % savings target.

Step 5: High‑interest savings accounts

Ana and Roberto open three separate high‑interest savings accounts—one for each goal. They compare interest rates and choose accounts with no fees or minimum balance requirements.

Step 6: Leverage technology

They use a budgeting app that tracks spending and automatically divides their savings contributions. A round‑up feature invests spare change into the vacation fund. They monitor progress monthly and adjust if they receive bonuses or extra income.

Result: After two years, they reach €6,000 for their Japan trip and book the vacation without incurring debt. By year three, they accumulate €9,000 toward the car and purchase a reliable used vehicle. At the end of five years, they have €50,000 saved for a down payment and closing costs, enabling them to buy their home.

Frequently Asked Questions (FAQs)

- How much should I save for a house down payment? Conventional mortgages often require 10–20 %. Larger down payments reduce monthly payments and may eliminate private mortgage insurance. Research programs in your area—some require as little as 3 % for first‑time buyers.

- Is it better to finance a car or pay cash? Paying cash avoids interest and reduces overall cost. However, if financing offers a low interest rate and you can earn more by investing your cash, financing may be worthwhile. Always compare loan rates and total interest paid.

- Should I invest money earmarked for a big purchase? If your goal is more than five years away, investing in low‑cost index funds could outpace savings accounts. However, if you need the money within a few years, keep it in a high‑yield savings account or short‑term certificate of deposit to avoid market volatility.

- What if I can’t meet the 20 % savings target in the 50/20/30 rule? Adjust your budget. DFPI recommends cutting back on discretionary spending if you struggle to meet the savings portiondfpi.ca.gov. Alternatively, increase income through side work or reallocate funds temporarily.

- How do I stay motivated while saving for a long‑term goal? Break your goal into milestones (e.g., saving the first €1,000). Celebrate small wins with inexpensive rewards. Use visual progress trackers, like charts or thermometer graphics, to see your accumulation grow.

- Can I work on multiple goals at once? Yes, but prioritize. Focusing on one goal at a time can accelerate progress and provide motivation. If your income allows, split savings across multiple goals like Ana and Roberto did in the case study.

- What role do budgeting apps play? Apps can automate saving, track spending and provide insights into where you could cut costs. DFPI encourages leveraging technology to aid saving effortsdfpi.ca.gov.

Conclusion

Saving for major purchases like a house, car or dream vacation doesn’t happen overnight. It requires identifying your goals, estimating costs, using budgeting and saving strategies, and staying committed. By setting SMART goals, paying yourself first, following a budgeting method that works for you, opening high‑interest savings accounts and leveraging technology, you can make your dreams tangible. Remember that everyone’s situation is unique—tailor these strategies to your income and timeline. With discipline and planning, big purchases become achievable, and you can enjoy them without the burden of debt.

Deja una respuesta