Introduction

Have you ever reached the end of the month and wondered where all your money went? Many people budget in their heads or use a single bank account for everything. Unfortunately, without clear boundaries it’s easy to overspend on dining out or shopping and leave nothing for savings or bills. The envelope budgeting method provides a simple, tangible solution: assign every dollar to a specific spending category and keep those funds separate. When an envelope runs out, you stop spending in that category until next month.

Financial educators note that there is no single perfect budget, but they highlight the envelope method as one of several effective strategies. It is closely related to zero‑based budgeting—both require allocating every dollar to a purposenerdwallet.com. In this article you’ll learn how envelope budgeting works, how to implement it with cash or digitally, and how to adapt the method to your income and lifestyle.

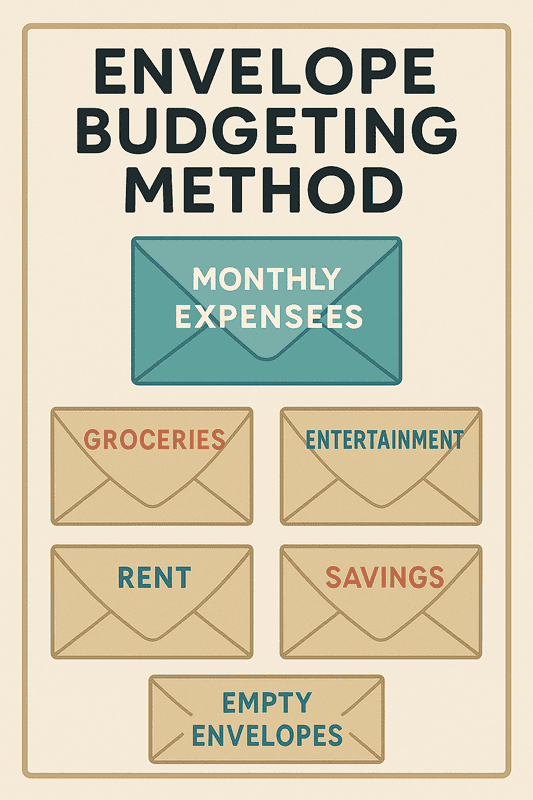

What Is Envelope Budgeting?

Envelope budgeting is a money‑management system where you divide your income into separate categories—“envelopes”—for different spending purposes. Traditionally this meant using physical envelopes with cash: one for rent, one for groceries, one for entertainment, and so on. When an envelope is empty, you stop spending in that category.

The envelope method offers several benefits:

- Clear visual limits. Seeing the amount of cash left in each envelope helps you understand how much you can spend and prevents you from accidentally overspending.

- Encourages intentional spending. You must decide in advance how much to allocate to each category, which forces you to think about priorities.

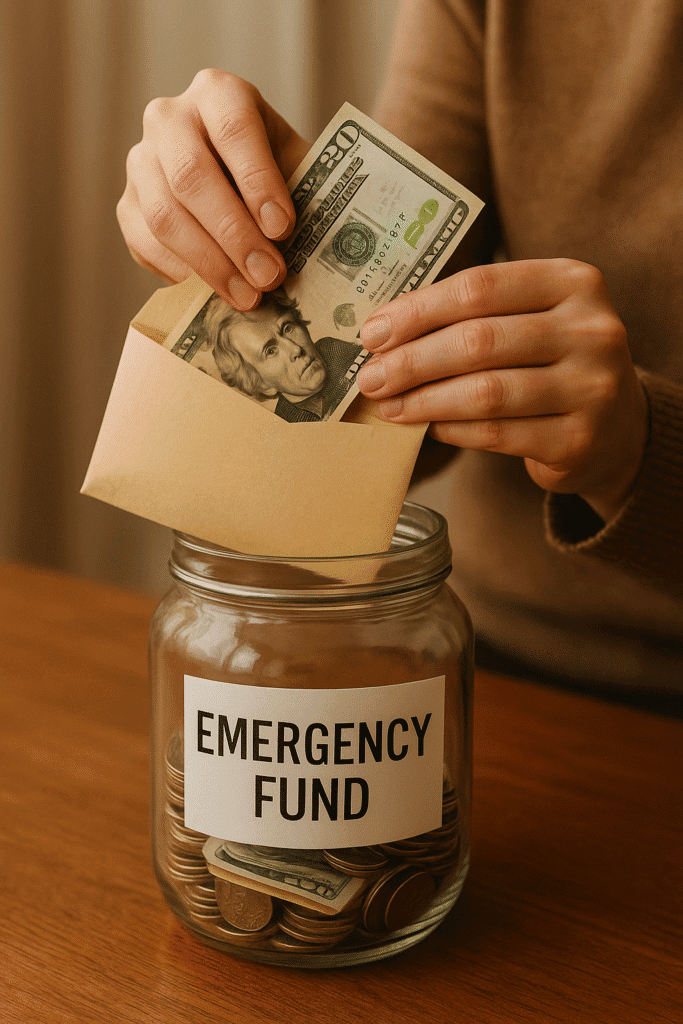

- Combines well with saving goals. The method is essentially a form of zero‑based budgeting; money left in envelopes at the end of the month can be moved into savings or emergency fundsnerdwallet.com.

While the envelope method originally used cash, modern digital tools allow you to implement the same strategy with bank accounts, budgeting apps and prepaid cards.

How Envelope Budgeting Works

1. Calculate Your Net Income

First, determine your take‑home pay after taxes and other deductions. Knowing your net income sets the ceiling for how much you can allocate across envelopes. For example, if you take home $3,000 a month, that’s the amount you have to distribute among your categories.

2. List Your Spending Categories

Create a list of spending categories that reflect your lifestyle. Common categories include:

- Housing: rent or mortgage, utilities, property taxes.

- Food: groceries, dining out.

- Transportation: fuel, public transit, car payments, insurance.

- Health: medical expenses, insurance premiums, prescriptions.

- Debt repayment: student loans, credit cards.

- Savings and investments: emergency fund, retirement accounts.

- Personal: clothing, haircuts, gym memberships.

- Entertainment and fun: hobbies, movies, streaming services.

Your categories should be as detailed as necessary. Having separate envelopes for things like “coffee shop” or “pet care” can help identify overspending patterns but may be cumbersome. Many people start with 6–10 categories and adjust as needed.

3. Assign Dollar Amounts to Each Envelope

Next, decide how much money to allocate to each category. This step requires examining your past spending to estimate realistic amounts. Ideally, the total of all envelopes equals your net income (similar to zero‑based budgeting)nerdwallet.com. Don’t forget to include a savings or “emergency fund” envelope, even if it’s small—consistent contributions build resilienceconsumerfinance.gov.

For example, with a $3,000 monthly income you might allocate:

| Category | Amount (USD) |

|---|---|

| Housing | 1,000 |

| Food | 450 |

| Transportation | 300 |

| Health | 150 |

| Debt repayment | 350 |

| Savings/emergency | 400 |

| Personal | 200 |

| Entertainment/fun | 150 |

| Miscellaneous | 50 |

| Total | 3,000 |

4. Fund Your Envelopes

There are two main ways to fund your envelopes:

- Physical cash envelopes. Withdraw the total amount of cash from your bank account and divide it into envelopes labelled with each category. You’ll carry envelopes for daily spending categories like food or entertainment and leave others (housing, savings) somewhere safe at home.

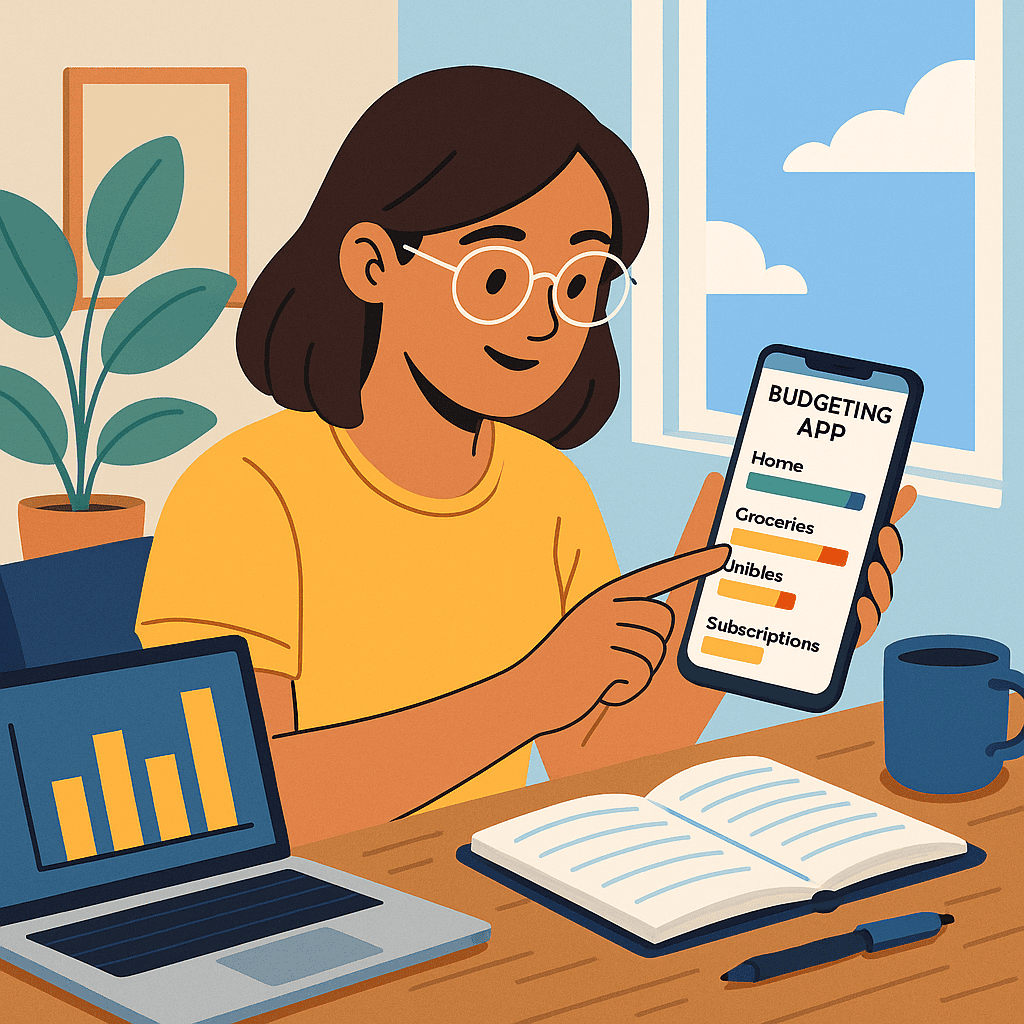

- Digital envelopes. Many budgeting apps (e.g., Goodbudget, Mvelopes, YNAB) allow you to create virtual envelopes. You connect your bank account, assign money to categories and track each transaction. Some banks let you open multiple sub‑accounts to act as envelopes, or you can use a spreadsheet and update your balances manually.

With cash envelopes the act of handing over physical money can reduce impulsive purchases. However, cash handling may be inconvenient and less secure. Digital envelopes offer convenience, automatic transaction tracking and integration with savings goals.

5. Spend Only From the Appropriate Envelope

Whenever you make a purchase, use money from the corresponding envelope:

- Buying groceries? Use cash from your Food envelope or mark the transaction in your digital food envelope.

- Paying a medical bill? Use the Health envelope.

- Wanting to buy concert tickets? Check the balance in the Entertainment envelope. If the envelope doesn’t have enough, either wait until it is refilled or reallocate money from another envelope.

Sticking to the envelope ensures you don’t overspend. If you run out of funds in a discretionary envelope (like entertainment), you have to wait until the next month or make a conscious decision to move money from another category.

6. Evaluate Leftover Funds and Adjust

At the end of each month, review the balances in your envelopes. If there is money left in a category, you can:

- Roll it over to the next month’s envelope, building a cushion for future expenses (e.g., vehicle maintenance or holiday gifts).

- Transfer it to savings or an extra debt payment. The zero‑based budgeting principle emphasises giving every leftover dollar a jobnerdwallet.com.

Reviewing leftovers helps you refine your budget. If you consistently underspend in a category, allocate less next month and put the difference toward savings or debt reduction. If you overspend, either increase the allocation or find ways to cut back.

Advantages of the Envelope Method

| Advantage | Explanation |

|---|---|

| Helps control overspending | The finite amount in each envelope forces you to stay within limits. If the dining‑out envelope is empty, you stop eating out or adjust. |

| Provides clear visual cues | Physical cash or digital envelope balances show exactly how much is left. |

| Aligns with zero‑based budgeting | Every dollar has a purpose; leftover funds are redirected to savings or debtnerdwallet.com. |

| Increases financial awareness | Assigning money to categories makes you more aware of spending habits and motivates change. |

| Can be tailored and combined | You can choose any number of envelopes, adjust amounts and combine with other strategies (pay yourself first, 50/20/30). |

Potential Drawbacks and Solutions

Although envelope budgeting has many benefits, be mindful of these challenges:

- Cash management risks. Carrying cash can be unsafe and less convenient. Solution: Use digital envelopes via budgeting apps or multiple bank sub‑accounts. Many banks now offer “bucket” features to divide checking or savings accounts into labelled sections.

- Time‑consuming to track. Updating paper envelopes or spreadsheets requires discipline. Solution: Choose an app that automatically imports transactions from your bank and categorises them. You still need to review and approve transactions, but it reduces manual entry.

- Rigid categories may not fit variable expenses. Some expenses (e.g., car repairs) are unpredictable. Solution: Create sinking funds—envelopes for infrequent expenses—where you contribute a small amount each month. When the bill arrives, you’ll have funds ready.

- Requires consistent monitoring. If you ignore envelope balances, you might overspend. Solution: Set aside a weekly “money date” to review envelopes, update balances and adjust if necessary.

Envelope Budgeting in the Digital Age

Many people love the tangibility of cash envelopes, but digital tools make the method accessible to those who prefer plastic. Here’s how to modernize envelope budgeting:

Budgeting Apps

- Goodbudget: Mimics the traditional envelope system; you create digital envelopes, assign funds and track spending. It offers a free version and a paid plan for more envelopes and accounts.

- You Need a Budget (YNAB): Combines zero‑based budgeting with digital envelopes. You allocate every dollar and use categories to guide spending. YNAB also emphasizes age‑of‑money—keeping money in your account for at least a month before spending.

- Mvelopes: A digital envelope app that allows unlimited envelopes and automatic transaction downloads. It is subscription‑based and offers coaching services.

Bank Sub‑Accounts or Buckets

Some banks let you create multiple sub‑accounts under a single checking or savings account. Each sub‑account functions like a digital envelope. For example, you can open separate savings buckets for “vacation,” “car maintenance” and “emergency fund.” Automate transfers into each bucket on payday.

Prepaid Cards and Cashless Options

You can load different categories onto separate prepaid debit cards—for instance, one card for groceries and another for entertainment. This strategy retains some of the physical separation of cash envelopes without carrying large amounts of cash.

Hybrid Approach

Combine physical and digital methods. Use cash envelopes for discretionary spending categories (food, entertainment) to curb impulse spending, and digital envelopes for fixed expenses and savings.

Integrating Envelope Budgeting With Other Methods

Envelope budgeting is not mutually exclusive; you can blend it with other strategies to enhance your budgeting system.

Envelope Budgeting + Pay Yourself First

After you automatically transfer a portion of your income to savings (pay yourself first), divide the remaining money into envelopes. This ensures your long‑term goals are funded while still controlling daily spending.

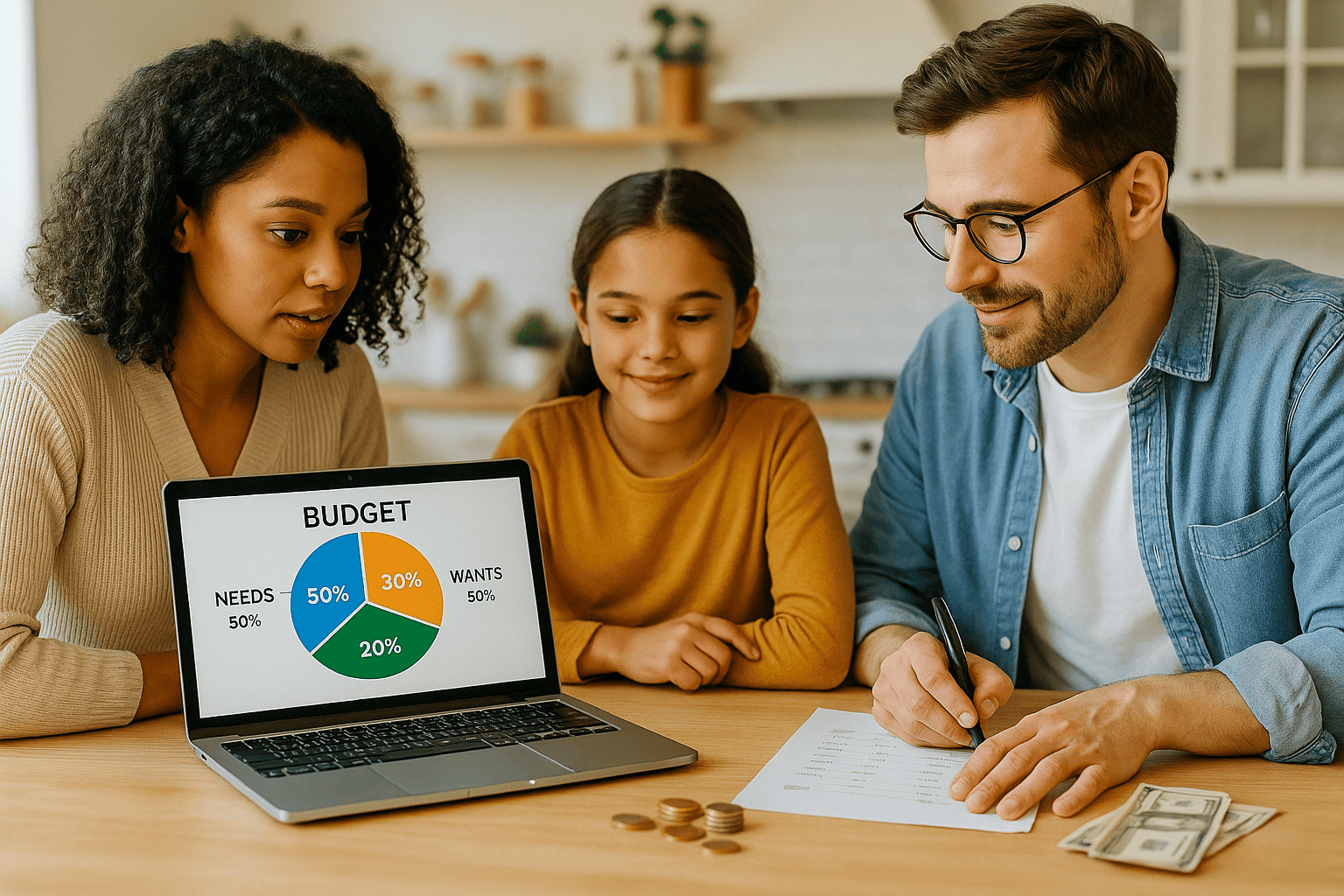

Envelope Budgeting + 50/20/30 Rule

You could allocate 50 % of your income to needs, 20 % to savings and 30 % to wants, then break down the needs and wants into individual envelopes. For example, the 30 % wants portion could be split into envelopes for dining out, entertainment, and hobbies.

Envelope Budgeting + Zero‑Based Budgeting

Envelope budgeting is essentially the envelope version of zero‑based budgeting because you assign every dollar to a categorynerdwallet.com. To integrate them, simply ensure your envelopes add up to your net income and zero out any leftover by moving it to savings or debt repayment.

Case Study: Implementing Envelope Budgeting

Background: Michael is a 35‑year‑old software engineer who earns $5,000 per month after taxes. He feels like his spending on dining out and hobbies often derails his saving plans. He decides to try the envelope method to regain control.

Envelope Setup: Michael lists his major expenses and hobbies. His categories and monthly allocations are:

- Housing: $1,200

- Food (groceries): $400

- Dining out: $300

- Transportation: $250

- Utilities & Insurance: $200

- Personal & Family: $300

- Entertainment & Hobbies: $300

- Debt repayment (student loan): $350

- Savings & Investments: $1,500

- Miscellaneous: $200

Michael chooses to combine envelope budgeting with the pay‑yourself‑first method. On payday he automatically transfers $1,500 to his savings accounts (retirement and emergency fund). He withdraws $1,800 in cash for his discretionary envelopes and leaves the rest in his checking account to pay fixed expenses online.

Execution: Michael uses physical envelopes for groceries, dining out, entertainment, personal & family, and miscellaneous. He uses a budgeting app to track the digital envelopes for housing, utilities & insurance, transportation, debt repayment, and savings. When he goes out with friends, he pays with cash from his dining envelope. If the envelope empties before the month ends, he either declines invitations or moves money from his entertainment envelope after careful consideration.

Results: After three months, Michael finds that he spends less on dining out and impulsive hobby purchases. He consistently contributes to his emergency fund and retirement accounts and has paid extra toward his student loan. The visual cue of envelopes helps him say “no” to excess spending. He decides to keep using the method and occasionally adjusts his envelope amounts to reflect changes in his lifestyle.

Frequently Asked Questions (FAQs)

- Can I use the envelope method if I rarely use cash?

Absolutely. Many apps mimic cash envelopes digitally. You can also create multiple bank sub‑accounts or use prepaid cards for each spending category. - How many envelopes should I have?

There is no fixed number. Start with major categories (housing, food, transportation, savings, entertainment) and add more as needed. Too many envelopes may be hard to manage; too few may not provide enough clarity. - What happens if an envelope runs out?

You have two options: stop spending in that category until next month or reassign funds from another envelope. Reassigning should be deliberate, not impulsive. - Do I still need a budget if I use envelopes?

Envelope budgeting is a budget. However, it may be helpful to track spending in a spreadsheet or app to identify patterns and make informed adjustments. - How do I handle irregular expenses like car repairs or annual subscriptions?

Create sinking fund envelopes for periodic expenses. Contribute a small amount each month so the funds are there when needed. For example, put $50 a month into a “car maintenance” envelope; after 12 months you have $600 for repairs. - Can I use envelope budgeting if my income fluctuates?

Yes, but you must estimate average monthly income and prioritise necessities. When income is higher, allocate extra to your envelopes and build a buffer for lean months. You may also pair it with the pay‑yourself‑first method, contributing a fixed percentage to savings before funding envelopes. - How do I decide how much to put in each envelope?

Review past bank statements to see where your money currently goes. Start with those amounts and adjust up or down depending on your goals. It often takes a few months to fine‑tune your allocations.

Conclusion

Envelope budgeting is a time‑tested method that brings structure to your spending and clarity to your finances. By assigning every dollar to a category, you create built‑in boundaries that prevent overspending and direct leftover funds toward savings or debt reduction. Whether you use physical envelopes or a digital app, the method encourages intentionality, transparency and discipline. While it requires effort to set up and monitor, the payoff is greater control over your money, less financial stress and faster progress toward your goals.

Ready to try envelope budgeting? Start by calculating your income, listing your categories and funding your envelopes. Combine it with the pay‑yourself‑first strategy and periodic reviews to ensure continued success. With practice, this simple system can transform the way you manage money and help you build the future you want.

Deja una respuesta