How to Build a Budget Using the 50/30/20 Rule

Introduction

Do you ever feel like your pay cheque disappears faster than you expect? Maybe you’re struggling to pay bills on time, or you’d like to save for a holiday but don’t know where to start. Budgeting is a powerful tool for taking control of your money, yet many people avoid it because they think it’s restrictive or complicated. In reality, a well‑designed budget gives you freedom: freedom from stress, freedom to enjoy life and freedom to pursue your goals. This article will introduce you to the 50/30/20 budgeting rule, an accessible framework that divides your income into three simple categories — needs, wants and savings. We’ll explain how it works, why it’s effective, how to implement it step by step and how it compares with other popular budgeting methods. By the end, you’ll have a practical blueprint for managing your money and building financial security.

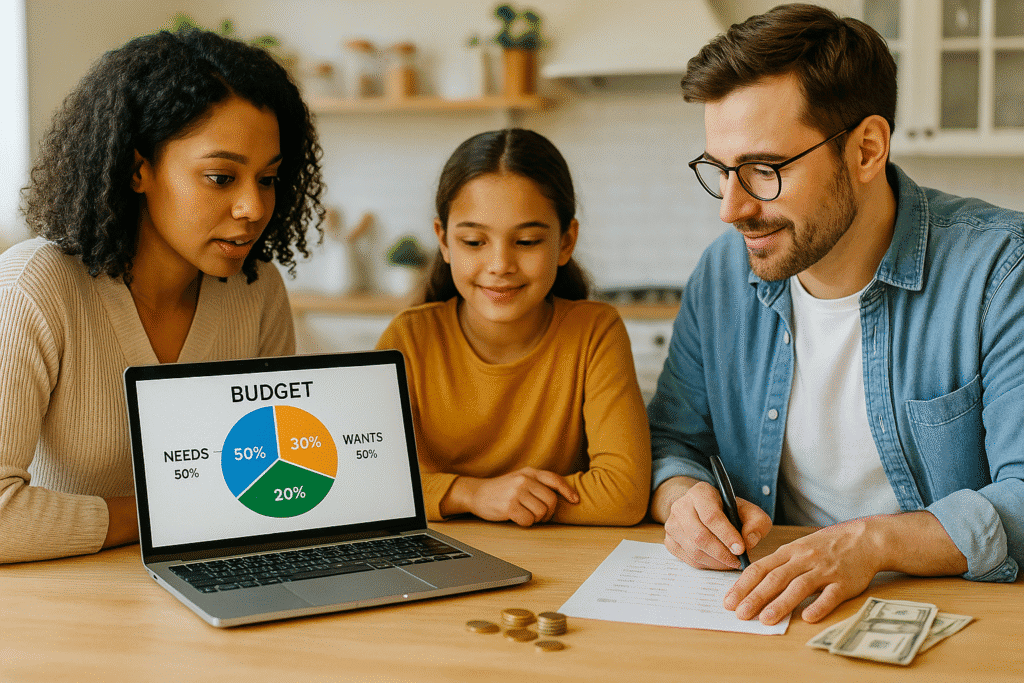

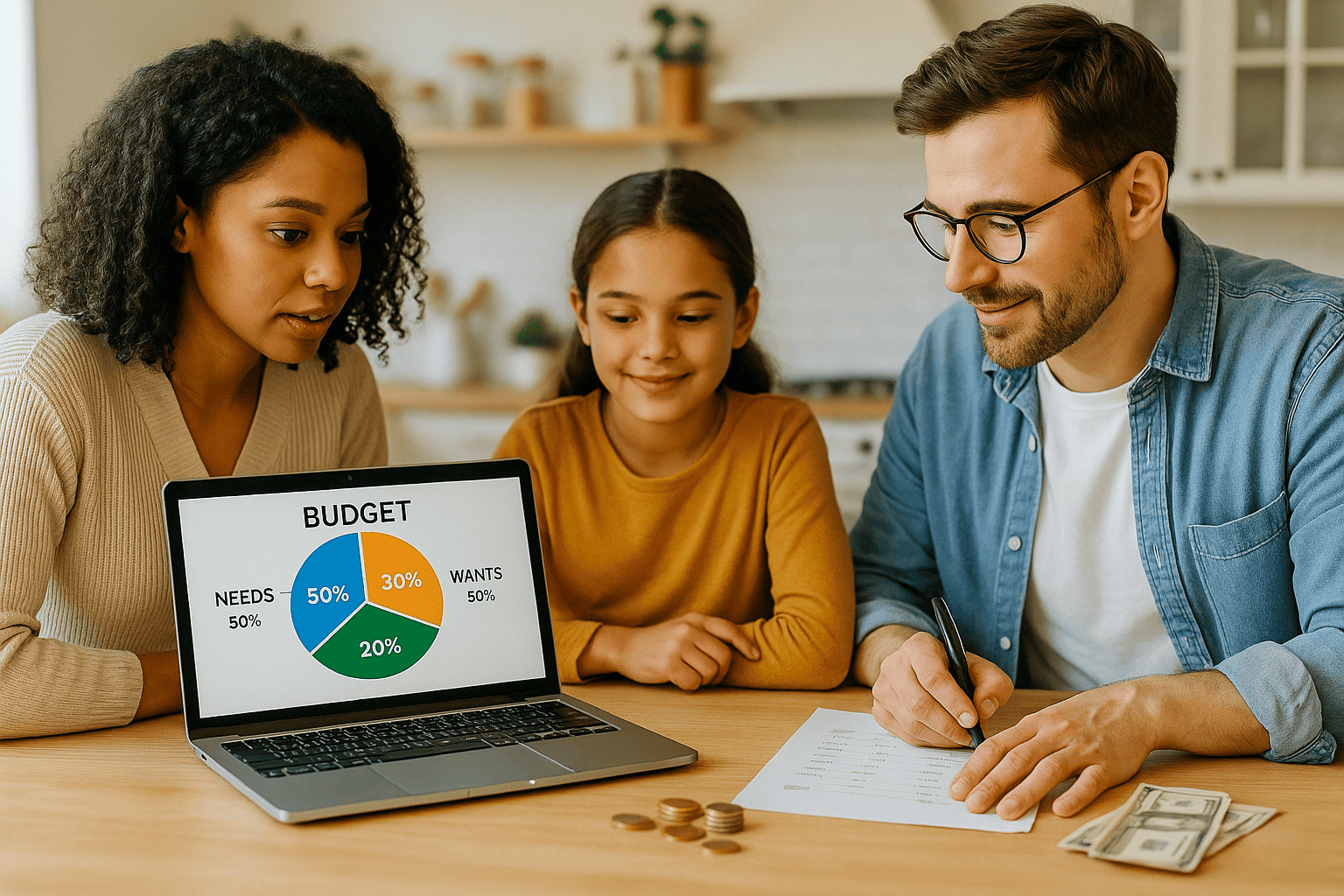

What Is the 50/30/20 Rule?

The 50/30/20 rule is a budgeting principle that categorises your take‑home pay into three buckets. According to the guide produced by Chase Bank, this method allocates 50 percent of your income to needs, 30 percent to wants and 20 percent to financial goals

chase.com

. The University of Pennsylvania’s financial wellness programme reinforces that the 50/20/30 approach (sometimes written as 50/30/20) is designed to help you balance essential expenses, savings and discretionary spending. The categories break down as follows:

Needs (50 %): essential expenses you must pay each month — housing, utilities, groceries, transportation, minimum debt payments and insurance

chase.com

. Your goal is to keep this category at or below half of your net income.

Wants (30 %): non‑essential expenses that enhance your lifestyle — dining out, hobbies, vacations, streaming subscriptions and other luxuries

chase.com

. These items bring enjoyment but can tempt you to overspend.

Goals (20 %): money set aside for savings, debt payoff and investing

chase.com

. This includes contributions to an emergency fund, retirement accounts and extra payments on loans.

This simple framework offers clarity and flexibility: it ensures that you cover necessities, treat yourself within limits and prioritise future security.

Why the 50/30/20 Rule Works

Simplicity – Allocating percentages is easier than tracking every penny. It gives you a clear snapshot of where your money should go without requiring complex spreadsheets.

Balance – The rule encourages balance between living for today and planning for tomorrow. It ensures you don’t neglect savings while still allowing room for enjoyment.

Adaptability – You can adjust the percentages slightly depending on your situation. For example, if your needs exceed 50 %, you might temporarily reduce wants until debts are paid.

However, this method isn’t one‑size‑fits‑all. People with high debt or living in expensive cities may find it difficult to keep necessities below 50 %. In those cases, the rule can serve as a starting point rather than a strict requirement.

Step‑by‑Step Guide to Implementing the 50/30/20 Budget

- Calculate Your Take‑Home Pay

Begin by determining your net income — the amount you receive after taxes and other payroll deductions. If you have irregular income (e.g., freelance work), use an average of the past few months.

- Identify Your Needs (50 %)

List all essential expenses you must pay each month:

Housing (rent or mortgage)

Utilities (electricity, water, internet, phone)

Groceries and household supplies

Transportation (public transit passes, fuel, car payments)

Minimum debt payments (credit cards, student loans)

Insurance premiums

Healthcare costs

Add these up and compare with 50 % of your net income. If your needs exceed 50 %, look for opportunities to reduce costs — perhaps by moving to a cheaper neighbourhood, renegotiating insurance rates or using public transportation more often.

- Allocate Your Wants (30 %)

Wants are the “nice to have” expenses that make life enjoyable. Examples include:

Eating out at restaurants

Entertainment (concerts, movies, streaming services)

Travel and vacations

Fashion and personal shopping

Gym memberships or hobbies

Keeping wants at or below 30 % prevents lifestyle inflation and ensures that discretionary spending doesn’t crowd out savings. This category is also the easiest to adjust if you need to free up money for goals.

- Fund Your Goals (20 %)

The final 20 % is dedicated to improving your financial health. Focus on:

Building an emergency fund – The Consumer Financial Protection Bureau notes that having a dedicated savings or emergency fund helps you recover from unexpected expenses and reach larger goals

consumerfinance.gov

. Aim for three to six months’ worth of essential expenses.

Paying down debt faster – Any amount you pay above the minimum on credit cards or loans counts as a goal. Reducing debt lowers interest costs and frees up future cash.

Saving for long‑term goals – Contribute to retirement accounts (401(k), IRA), save for a down payment or invest in a diversified portfolio.

If you’re struggling to meet the 20 % target, start smaller and increase contributions as your income grows or expenses decrease.

- Track and Adjust

Use a budgeting app, spreadsheet or notebook to monitor your spending. Review your numbers monthly and make adjustments. For example, if your “needs” spending consistently falls at 55 %, look for ways to reduce expenses or increase income.

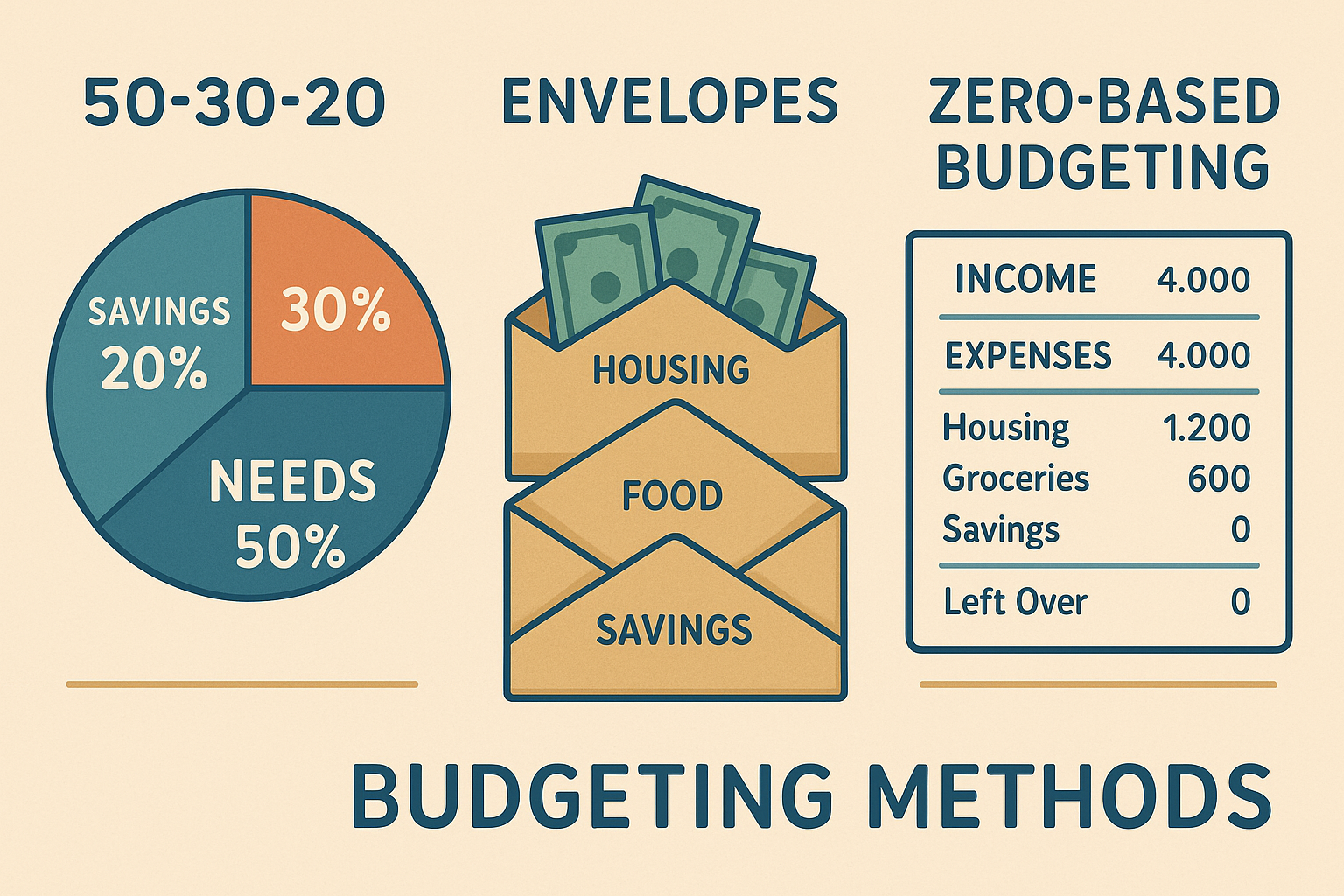

Comparing the 50/30/20 Rule with Other Budgeting Methods

While the 50/30/20 framework is popular, other budgeting techniques might suit your personality or situation better. The University of Pennsylvania outlines several alternative methods:

Pay Yourself First

In the Pay Yourself First method, the first “bill” you pay each month is a transfer to your savings account. After saving, you pay your bills and use the rest for discretionary spending. This approach ensures that you prioritise saving and can be combined with other budgets. It works well for people who struggle to save consistently.

Zero‑Based Budgeting

A Zero‑Based Budget assigns every dollar of income to a specific purpose, leaving a balance of zero at the end of the month. You plan for every expense and savings contribution ahead of time. This method requires more discipline and planning but gives you complete control over your money. It’s useful for individuals with irregular income or those who want to maximise efficiency.

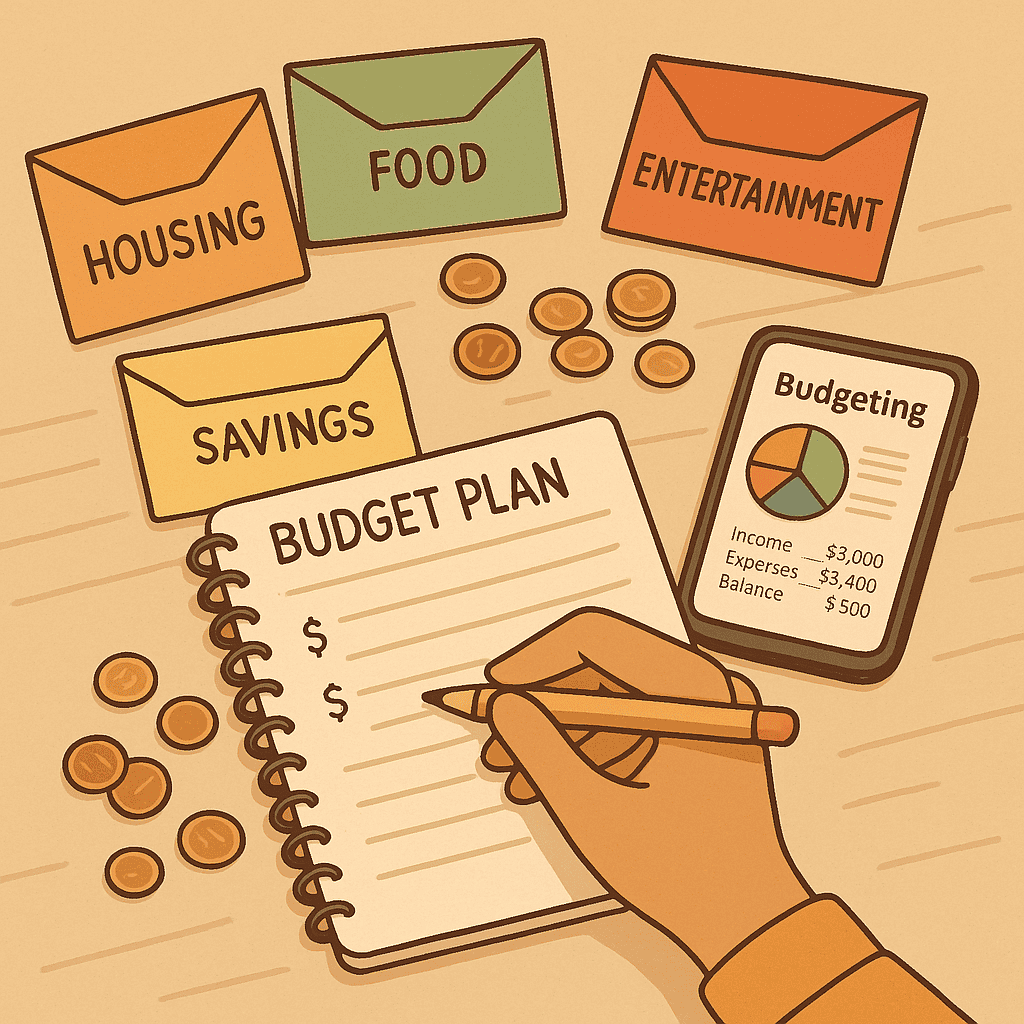

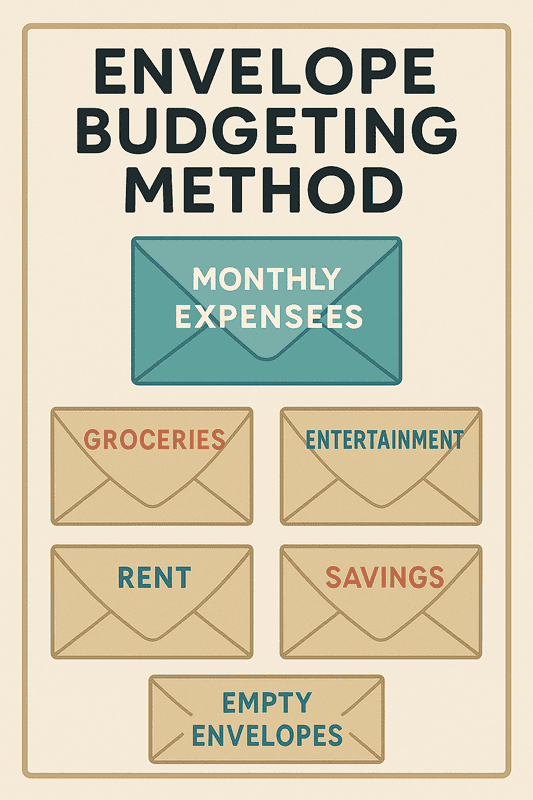

Envelope Budgeting (Cash or Digital)

The Envelope Budget divides your money into envelopes (physical or digital) representing categories like groceries, entertainment and transport. Once an envelope is empty, you cannot spend more in that category until the next period. This method works well for curbing overspending and building awareness of your habits. Digital budgeting apps replicate the envelope concept if you prefer not to use cash.

Choosing the Right Method

Your ideal budgeting system depends on your personality, income stability and financial goals. The 50/30/20 rule provides a flexible starting point. However, if you need stricter control, you might prefer zero‑based budgeting. If saving is your weak spot, paying yourself first ensures you set money aside. And if you struggle with impulsive spending, the envelope method can provide a clear stop‑gap.

Case Study: Applying the 50/30/20 Rule

Consider Maria, a 30‑year‑old graphic designer earning $3 500 per month after taxes. She has student loan debt and wants to save for an emergency fund.

Calculate take‑home pay: $3 500 per month.

Allocate to needs (50 %): $1 750 goes to rent, utilities, groceries, transportation and minimum loan payments.

Allocate to wants (30 %): $1 050 covers eating out, entertainment, clothing and subscriptions. She realises she’s spending $300 on restaurants, so she plans to cook at home more often.

Allocate to goals (20 %): $700 is split between building a $5 000 emergency fund and making extra payments toward her student loans.

Monitor and adjust: After three months, Maria’s emergency fund reaches $2 100. She decides to reduce her wants budget to 25 % and increase her savings to pay off her loans sooner.

This case illustrates how flexible the rule can be. Even slight adjustments to the percentages can accelerate debt repayment or savings without dramatically reducing quality of life.

Frequently Asked Questions (FAQs)

What counts as a “need” versus a “want”?

A need is a mandatory expense required to live and work: housing, utilities, groceries, basic transportation, insurance and minimum debt payments

chase.com

. A want enhances your lifestyle but isn’t essential: dining out, streaming services, gym memberships and vacations

chase.com

. Sometimes the line is blurry (e.g., clothing), so apply common sense — basic clothing is a need; designer outfits are wants.

What if my needs exceed 50 % of my income?

Many people, especially in high‑cost areas, spend more than half their income on necessities. If this is your situation, aim to reduce expenses (e.g., move to a cheaper home, refinance loans) or increase income. You can temporarily lower the wants or goals percentages until your needs are under control.

Should I follow the rule exactly?

Not necessarily. The 50/30/20 split is a guideline, not a rigid requirement. Adjust the percentages to suit your circumstances. For instance, you might do 60/20/20 (needs/wants/goals) while paying off a mortgage, then shift to 40/30/30 after clearing debt.

How do I track my spending?

Use a budgeting app (e.g., You Need a Budget, EveryDollar), a spreadsheet or even paper envelopes. The key is consistency: record every expense and review your budget monthly. Many apps allow you to categorise transactions automatically and compare them to your budget.

Can I combine the 50/30/20 rule with other methods?

Yes. For example, you can apply Pay Yourself First within the 20 % goals category by automating your savings transfers. You can also use envelopes to control spending within the 30 % wants category or implement zero‑based budgeting when planning specific purchases.

Conclusion

The 50/30/20 budgeting rule is a practical framework that simplifies money management by dividing your after‑tax income into needs, wants and goals

chase.com

. By allocating 50 % of your earnings to essential expenses, 30 % to discretionary spending and 20 % to savings and debt repayment, you can balance your lifestyle today with your financial security tomorrow. The method’s simplicity makes it accessible to anyone new to budgeting, and its flexibility allows you to adjust percentages as your circumstances change. Comparing the rule with alternative budgets — Pay Yourself First, Zero‑Based and Envelope methods — helps you choose the approach that best matches your personality and goals.

Budgeting isn’t about restriction; it’s about empowerment. By setting clear boundaries and priorities, you free yourself from the stress of living paycheque to paycheque and give your future self the gift of financial stability. Start by calculating your take‑home pay, categorising your expenses and making small changes. Whether you stick strictly to 50/30/20 or adapt it to your life, the most important step is to begin. Take control of your money today and build the foundation for the life you want tomorrow.

Deja una respuesta